Travel Insurance FAQs What Every Traveler Should Know

Types of Travel Insurance

Choosing the right travel insurance plan is crucial for a worry-free trip. Understanding the different types of coverage available will help you select the plan that best suits your needs and budget. This section will Artikel the key differences between comprehensive, basic, and specialized travel insurance plans, highlighting their benefits and limitations.

Comprehensive travel insurance plans offer the most extensive coverage. They typically include a wide range of benefits, protecting you against various unforeseen circumstances during your travels. Basic plans provide more limited coverage, focusing on essential protections. Specialized plans cater to specific needs, such as adventure travel or business trips. The optimal choice depends on the individual’s travel style, destination, and personal risk tolerance.

Comprehensive Travel Insurance

Comprehensive travel insurance provides the broadest protection, covering a wide array of potential issues. This includes medical emergencies, trip cancellations or interruptions, lost or stolen baggage, and personal liability. For example, if you experience a medical emergency requiring hospitalization abroad, a comprehensive plan would cover the cost of medical treatment, evacuation, and repatriation. Similarly, if your flight is cancelled due to unforeseen circumstances, a comprehensive plan would reimburse you for any non-refundable expenses. It offers peace of mind knowing that you are protected against a wide spectrum of travel-related problems.

Basic Travel Insurance

Basic travel insurance plans offer more limited coverage compared to comprehensive plans. They typically cover essential aspects such as medical emergencies and trip cancellations due to specific, defined reasons (such as severe weather impacting the airport). Coverage amounts are usually lower than comprehensive plans, and they might exclude certain benefits like baggage loss or personal liability. A basic plan might be suitable for short trips to low-risk destinations where the potential for significant unforeseen events is considered minimal. For example, a short business trip to a nearby city might only require coverage for medical emergencies and trip cancellation due to severe weather.

Specialized Travel Insurance

Specialized travel insurance plans are designed for specific travel needs or activities. These plans often cater to individuals engaging in high-risk activities, such as adventure travel, extreme sports, or business trips requiring specific coverage. For instance, a plan designed for adventure travel would cover injuries sustained while participating in activities like mountaineering or scuba diving, which might be excluded from standard plans. Similarly, business travel insurance often includes coverage for lost business documents or missed meetings due to travel disruptions. Choosing a specialized plan ensures that your specific needs are met, providing appropriate coverage for unique circumstances.

Comparison of Travel Insurance Plans

| Feature | Comprehensive | Basic | Specialized |

|---|---|---|---|

| Medical Expenses | High Coverage | Limited Coverage | Varies by specialization |

| Trip Cancellation/Interruption | Broad Coverage, many reasons | Limited Coverage, specific reasons | Varies by specialization |

| Baggage Loss/Delay | Covered | May be excluded or limited | Varies by specialization |

| Emergency Evacuation/Repatriation | Covered | May be excluded or limited | Varies by specialization |

Coverage for Medical Emergencies

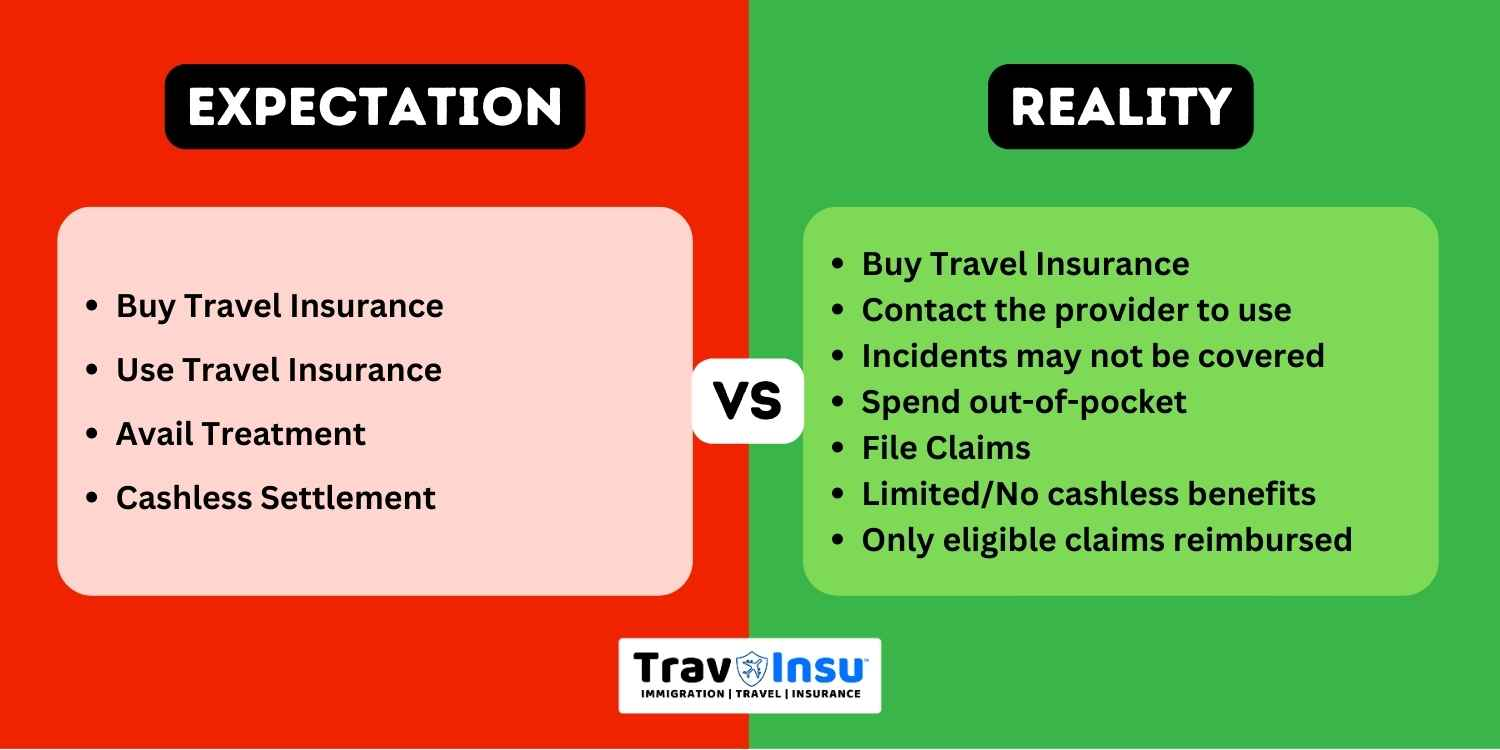

Travel insurance offers crucial protection against unexpected medical emergencies while traveling abroad. Understanding the scope of this coverage is vital for peace of mind and financial security during your trip. This section details what is typically covered, what might be excluded, and the claims process.

Medical emergency coverage in travel insurance policies typically includes expenses related to accidents or sudden illnesses that occur during your trip. This usually encompasses emergency medical treatment, hospital stays, ambulance transportation, and even medical evacuation in critical situations. The specific coverage amounts and details will vary depending on the policy you choose, so carefully reviewing the policy documents before your trip is essential.

Covered Medical Situations

Many travel insurance policies cover a wide range of medical emergencies. These commonly include:

- Treatment for injuries resulting from accidents, such as fractures, lacerations, or concussions.

- Care for sudden illnesses, such as appendicitis, heart attacks, strokes, or severe infections.

- Emergency surgery and hospitalization costs.

- Costs associated with ambulance transportation to a medical facility.

- Repatriation of remains in the tragic event of death.

It’s important to note that the specific definition of a “medical emergency” can vary between policies. Some policies might have stricter criteria for what qualifies as a covered event.

Excluded Medical Situations

While travel insurance provides extensive medical coverage, some situations are typically excluded. These exclusions are often clearly Artikeld in the policy’s terms and conditions. Examples include:

- Pre-existing medical conditions: Conditions that existed before the policy’s effective date are usually not covered unless specifically addressed through a rider or additional coverage.

- Routine medical check-ups or elective procedures: These are not considered emergencies and are generally excluded.

- Injuries or illnesses resulting from engaging in dangerous activities not explicitly covered by the policy (e.g., extreme sports without appropriate add-on coverage).

- Treatment for conditions caused by self-inflicted injuries or drug abuse.

- Medical expenses incurred due to a lack of necessary preventative measures (e.g., failing to take necessary precautions against mosquito-borne illnesses).

Filing a Medical Claim, Travel Insurance FAQs: What Every Traveler Should Know

The claims process for medical expenses incurred abroad typically involves several steps. First, it’s crucial to keep all original receipts and medical documentation. This includes bills from hospitals, doctors, and pharmacies, as well as any other relevant medical reports. Next, contact your insurance provider as soon as possible to report the incident and initiate the claims process. They will provide you with specific instructions and necessary forms. You’ll generally need to submit the completed claim form, along with copies of your passport, travel itinerary, and all relevant medical documentation. The insurance company will then review your claim and process the reimbursement based on your policy’s terms and conditions. The processing time can vary depending on the complexity of the claim and the insurer’s procedures. It is recommended to carefully read your policy documents for specific instructions and deadlines related to submitting your claim.

Trip Cancellation and Interruption

Trip cancellation and interruption insurance is a crucial component of comprehensive travel insurance. It protects you financially from unforeseen circumstances that might force you to cancel your trip before departure or cut it short while you’re already traveling. Understanding the specifics of this coverage is essential for peace of mind while planning your adventures.

Trip cancellation or interruption coverage typically applies when unforeseen and unavoidable circumstances prevent you from traveling as planned. These circumstances are usually Artikeld in your policy’s terms and conditions, and often involve events outside of your control. The specific events covered vary depending on the policy, but generally include situations that directly impact your ability to travel or make it unsafe to continue your journey.

Circumstances Covered by Trip Cancellation and Interruption Insurance

This section details situations that commonly qualify for coverage under trip cancellation and interruption policies. It is important to remember that specific coverage details are determined by the individual policy purchased. Always refer to your policy documents for the most accurate information. Examples of events that often qualify include:

- Serious illness or injury of the insured traveler or a close family member requiring immediate medical attention.

- Unexpected death of a close family member.

- Damage to the insured traveler’s home that renders it uninhabitable.

- Severe weather conditions rendering travel unsafe or impossible, such as hurricanes, blizzards, or floods impacting the destination or origin.

- Unexpected job loss (often requires specific policy wording and proof).

- Terrorist attacks or civil unrest at the destination significantly impacting travel safety.

Circumstances Typically Not Covered by Trip Cancellation and Interruption Insurance

It’s equally important to understand situations that usually won’t be covered. These exclusions are often designed to prevent misuse of the insurance. Typical examples include:

- Pre-existing medical conditions (unless specifically covered with an additional rider). Policies often have waiting periods before coverage applies for pre-existing conditions.

- Changes of mind or simply deciding not to go on the trip.

- Missed flights due to overslept or other personal negligence.

- Routine maintenance or mechanical issues with vehicles (unless related to a covered event, such as a severe weather event causing damage).

- Travel advisories or warnings issued by government bodies (unless the advisory explicitly mandates evacuation or prohibits travel).

Required Documentation for Filing a Claim

When filing a claim for trip cancellation or interruption, thorough documentation is crucial to support your case. Failure to provide the necessary documents may delay or even prevent the successful processing of your claim.

- Copy of your travel insurance policy: This document Artikels your coverage and the claims process.

- Detailed itinerary: This should include flight confirmations, hotel reservations, and any other planned activities.

- Proof of cancellation or interruption: This could include a cancellation confirmation from airlines or hotels, medical records, police reports, or other relevant documentation depending on the reason for cancellation.

- Supporting documentation related to the reason for cancellation or interruption: For example, a doctor’s note for illness, a death certificate, or a news report verifying a natural disaster.

- Financial documentation of losses: This includes receipts for non-refundable travel expenses, such as airline tickets, hotel bookings, and tour packages.

Baggage Loss and Delay

Travel insurance often includes coverage for lost, stolen, or delayed baggage, offering peace of mind during your travels. This coverage can significantly alleviate the financial burden and inconvenience associated with such unfortunate events. Understanding the specifics of your policy and the claims process is crucial for a smooth resolution.

Most travel insurance policies provide coverage for the repair or replacement of damaged baggage, as well as reimbursement for essential items purchased while your luggage is delayed or lost. The amount of coverage varies depending on the specific policy and the declared value of your belongings. It’s important to note that pre-existing conditions or damage to luggage might not be covered, so always review your policy’s terms and conditions carefully. Some policies may also offer coverage for baggage delays, providing reimbursement for essential expenses incurred while waiting for your luggage to arrive.

Reporting Lost or Delayed Baggage to the Insurance Provider

Prompt reporting is key to initiating a successful claim. When faced with lost or delayed baggage, immediately notify the airline or relevant transportation provider and obtain a written report documenting the incident, including details like baggage tag numbers and descriptions of the lost items. This report will serve as crucial evidence when filing a claim with your insurance provider. Next, contact your insurance company as soon as possible. Most policies have specific timeframes for reporting, so adhering to these guidelines is essential. Be prepared to provide them with the details from the airline report, along with your policy number and other relevant personal information.

Filing a Baggage Claim

Filing a claim for baggage-related losses typically involves a straightforward process.

- Gather Necessary Documentation: Collect all relevant documentation, including your travel insurance policy, the airline’s lost baggage report, receipts for any replacement items purchased, and photographs of the damaged or lost luggage and its contents. Detailed descriptions and valuations of your belongings will be necessary.

- Complete the Claim Form: Your insurance provider will likely require you to complete a claim form. This form will ask for details about the incident, your personal information, and the value of your lost or damaged items. Be accurate and thorough in completing this form.

- Submit Your Claim: Submit your completed claim form along with all supporting documentation to your insurance provider. You can usually do this via mail, email, or through their online portal. Keep a copy of everything for your records.

- Follow Up: After submitting your claim, follow up with your insurance provider to check on its status. This helps ensure that your claim is processed efficiently and that you receive updates on the timeline.

Remember to always keep detailed records of your belongings, including photos and purchase receipts. This can significantly assist in the claims process, allowing for accurate valuation of your losses. Policies may also have limits on the amount of reimbursement for specific items or the total value of lost or damaged baggage. Therefore, carefully review your policy details before traveling.

Emergency Assistance Services

Travel insurance often includes a crucial component: emergency assistance services. These services provide vital support during unexpected and difficult situations while traveling, offering peace of mind knowing help is readily available. They go beyond simple financial coverage, offering practical assistance to navigate challenging circumstances.

Emergency assistance services typically encompass a wide range of support, designed to help travelers overcome unforeseen difficulties and ensure their safety and well-being. These services are often accessed via a 24/7 hotline, connecting travelers directly with experienced professionals who can provide guidance and arrange necessary interventions.

Types of Emergency Assistance

Emergency assistance services commonly cover a variety of situations. These services aim to provide timely and effective help, minimizing disruption and ensuring the traveler’s safety and well-being. The specific services offered can vary depending on the policy, but common examples include medical evacuation, repatriation of remains, emergency medical expenses, legal assistance, and lost document replacement.

Examples of Emergency Assistance Situations

Several scenarios highlight the value of emergency assistance services. For instance, a traveler experiencing a severe medical emergency in a remote location might require medical evacuation to a facility with appropriate care. Similarly, if a traveler becomes seriously ill or injured abroad, repatriation services can facilitate their return home for continued treatment. In the tragic event of a traveler’s death abroad, repatriation of remains ensures a dignified return home for burial or cremation. Beyond medical emergencies, emergency assistance can also cover situations like lost passports, requiring assistance with document replacement to facilitate the traveler’s return home.

Accessing Emergency Assistance Services

A clear understanding of how to access emergency assistance is vital. The process typically begins with contacting the insurance provider’s 24/7 emergency assistance hotline. Following this initial contact, the assistance team will gather necessary information, assess the situation, and coordinate the appropriate response. This might involve arranging medical transport, contacting local authorities, or providing financial assistance. The provider will work closely with the traveler and their family to resolve the situation efficiently and effectively.

Pre-existing Conditions: Travel Insurance FAQs: What Every Traveler Should Know

Travel insurance policies handle pre-existing medical conditions differently. Understanding these variations is crucial for ensuring adequate coverage during your trip. Some policies may offer limited or no coverage for conditions that existed before the policy’s effective date, while others may provide varying degrees of protection depending on the severity and nature of the condition. It is vital to carefully review the policy wording to understand the specific exclusions and limitations.

Pre-existing conditions are typically defined as any medical condition, illness, or injury that you received medical advice, treatment, or medication for within a specified period before your travel insurance policy’s start date. This timeframe varies between insurers, ranging from a few weeks to several months. Accurate and complete disclosure of all pre-existing conditions is paramount when applying for travel insurance. Failure to do so can result in a claim being denied, even if the pre-existing condition is not directly related to the reason for your claim.

Disclosure of Pre-existing Conditions

The application process for travel insurance typically involves a detailed health questionnaire. You are required to accurately and completely list all pre-existing medical conditions, including the dates of diagnosis, treatment received, and any ongoing medication. Providing false or incomplete information can invalidate your policy and jeopardize your ability to receive compensation for covered events. Insurance companies use this information to assess the risk associated with insuring you and to determine appropriate coverage levels and premiums. It’s crucial to answer all questions honestly and thoroughly, even if you believe the condition is minor or unlikely to affect your trip.

Coverage Options for Travelers with Pre-existing Conditions

Several coverage options exist for travelers with pre-existing health issues, though the availability and specifics vary widely depending on the insurer and the nature of the condition. Some insurers offer policies specifically designed for travelers with pre-existing conditions, although these policies often come with higher premiums. Other insurers may offer supplemental coverage to address specific pre-existing conditions, but this usually requires a separate application and approval process. Some policies may exclude coverage for conditions related to pre-existing issues, while others may offer limited coverage for emergency treatment related to a pre-existing condition, perhaps with a higher deductible or co-pay. For example, a policy might cover emergency treatment for a heart condition that is pre-existing but only if the treatment is unrelated to a pre-existing condition, such as a sudden exacerbation requiring immediate hospitalization. Always compare policies carefully to find the best option that balances your needs and budget. It’s advisable to seek advice from a travel insurance specialist to navigate the complexities of coverage for pre-existing conditions.

Activities and Exclusions

Travel insurance policies, while designed to offer comprehensive protection, often have limitations on the activities they cover and specific events they exclude. Understanding these limitations is crucial for ensuring you have adequate protection for your trip. Failing to do so could leave you financially responsible for unexpected costs.

It’s important to carefully review your policy’s terms and conditions before your departure to understand exactly what is and isn’t covered. Many policies provide specific details on covered activities and exclusions. If you have any doubts, contacting your insurance provider directly is always recommended.

Common Activities Not Covered by Standard Policies

Standard travel insurance policies typically exclude coverage for activities considered high-risk or inherently dangerous. These exclusions are in place because the probability of injury or loss is significantly higher in these activities, making them financially unviable to insure without significant premium increases. This does not mean that no insurance exists for these activities; specialized policies catering to adventurers and extreme sports enthusiasts are available, but they usually come with higher premiums.

Examples of Excluded Events and Situations

Several events and situations are frequently excluded from standard travel insurance policies. These exclusions are often related to pre-existing medical conditions, known risks, or events considered outside the scope of typical travel-related incidents. For instance, a pre-existing condition flaring up during travel is often excluded unless specifically covered by an add-on. Similarly, events caused by war, terrorism, or civil unrest are frequently excluded due to the unpredictable and often uncontrollable nature of these situations.

Common Exclusions and Their Implications

Understanding the implications of common exclusions is vital for making informed decisions about your travel insurance coverage. Here’s a bulleted list illustrating some typical exclusions:

- Pre-existing medical conditions: Unless specifically covered with an additional premium, pre-existing conditions that manifest during the trip are typically excluded. This means that if you experience a flare-up of a chronic illness, you may be responsible for all associated medical expenses.

- Extreme sports and hazardous activities: Activities like skydiving, bungee jumping, and mountaineering are often excluded from standard policies. Participation in these activities without specialized coverage could lead to significant personal financial liability in case of injury or accident.

- Acts of war or terrorism: Coverage for injuries or losses resulting from acts of war, terrorism, or civil unrest is typically excluded. Travel to regions with ongoing conflict or high security risks should be approached with extreme caution, and alternative insurance solutions may be necessary.

- Willful misconduct or illegal activities: Claims resulting from actions deemed willful misconduct or participation in illegal activities are generally not covered. This underscores the importance of responsible travel behavior.

- Failure to follow medical advice: If you fail to follow the advice of a medical professional while traveling and subsequently incur additional costs, these costs may not be covered by your insurance policy.

Choosing the Right Policy

Selecting the appropriate travel insurance policy requires careful consideration of several key factors to ensure adequate coverage for your specific needs and trip details. Failing to do so could leave you vulnerable to significant financial losses in the event of unforeseen circumstances. A well-chosen policy provides peace of mind, allowing you to fully enjoy your travels.

Factors influencing policy selection are multifaceted and interconnected. The destination, trip duration, planned activities, and the traveler’s individual circumstances all play a crucial role in determining the necessary level and type of coverage. It’s vital to assess these factors objectively before comparing different policy options.

Factors to Consider When Choosing a Travel Insurance Policy

Destination, trip length, and planned activities are primary considerations. For instance, a trip to a remote location with limited medical facilities will necessitate a policy with comprehensive medical coverage, potentially including medical evacuation. A longer trip will naturally require a policy with a longer duration of coverage. Engaging in high-risk activities like scuba diving or mountaineering demands a policy that specifically covers these activities, as standard policies may exclude them. Pre-existing medical conditions also significantly impact policy selection, requiring careful review of the policy’s terms regarding coverage limitations. The age of the traveler is another factor; older travelers may require policies with higher medical coverage limits. Finally, the value of your belongings and the cost of your trip are essential factors in determining the appropriate level of coverage for baggage loss and trip cancellation/interruption.

Questions to Ask When Comparing Travel Insurance Options

Before committing to a policy, a structured comparison is essential. This involves asking specific questions to clarify coverage details and policy limitations. For example, inquiring about the specific medical coverage limits, the process for filing a claim, and any exclusions related to pre-existing conditions is crucial. Understanding the policy’s cancellation and interruption clauses is equally important. Clarifying whether the policy covers specific activities, the extent of baggage coverage (including specific limits and deductibles), and the availability of 24/7 emergency assistance services will provide a comprehensive understanding of what is offered. Comparing the premium cost against the level of coverage is also crucial.

Evaluating the Value and Cost-Effectiveness of Various Policies

Evaluating cost-effectiveness requires a balanced approach, considering the premium cost alongside the extent of coverage provided. A cheaper policy may offer inadequate coverage in the event of a significant incident, leading to greater financial losses. Conversely, an expensive policy with extensive coverage may be unnecessary for a low-risk trip. A cost-effective policy balances premium cost with sufficient coverage to mitigate potential risks. For example, a traveler planning a short, low-risk trip might find a basic policy sufficient, while a traveler embarking on an adventurous expedition might opt for a more comprehensive, albeit more expensive, policy. To assess value, consider the potential financial implications of various scenarios (e.g., medical emergency, trip cancellation) against the policy’s premium. Comparing several policies side-by-side, using a standardized comparison table, allows for a more objective assessment of value and cost-effectiveness.

Filing a Claim

Filing a travel insurance claim can seem daunting, but understanding the process and gathering the necessary documentation beforehand can significantly streamline the experience. Remember, prompt and accurate reporting is crucial for a successful claim. The specific steps may vary slightly depending on your insurer, so always refer to your policy documents for detailed instructions.

Claim Filing Process

The claim filing process generally involves several key steps. Following these steps diligently will increase the likelihood of a smooth and successful claim resolution.

- Review your policy: Before contacting your insurer, carefully review your policy documents to understand your coverage, the claims process, and any deadlines for filing a claim. Note any specific requirements or forms needed.

- Report the incident promptly: Most policies require you to report the incident as soon as reasonably possible. This often involves contacting your insurer’s emergency assistance hotline (the number is usually found on your policy documents). The sooner you report, the better they can assist you and start the claims process.

- Gather necessary documentation: This is a critical step. The required documentation varies depending on the type of claim, but generally includes forms provided by your insurer, proof of purchase (e.g., flight tickets, hotel reservations), and evidence supporting your claim (e.g., medical bills, police report).

- Complete and submit the claim form: Your insurer will provide a claim form that needs to be accurately and completely filled out. Provide all requested information clearly and concisely. Double-check for any errors before submitting.

- Submit supporting documentation: Attach all necessary supporting documents to your claim form. Keep copies of everything for your records. Consider sending documents via certified mail to have proof of delivery.

- Follow up: After submitting your claim, follow up with your insurer within a reasonable timeframe to check on its status. Keep records of all communication with the insurer.

Required Documentation Examples

The specific documentation needed varies depending on the type of claim. Here are a few examples:

- Medical Emergency Claim: Original medical bills, doctor’s reports, prescriptions, receipts for transportation to and from medical facilities, and a detailed description of the incident.

- Trip Cancellation Claim: Confirmation of the cancelled trip (e.g., flight cancellation notice, hotel cancellation confirmation), reasons for cancellation (e.g., doctor’s note, official notice of a natural disaster), and any non-refundable expenses incurred.

- Baggage Loss Claim: Baggage claim tag, airline baggage report, detailed inventory of lost items with purchase receipts or proof of ownership, and photos of the lost luggage.

- Trip Interruption Claim: Proof of the unforeseen event causing the interruption (e.g., flight cancellation confirmation, weather report), receipts for additional expenses incurred due to the interruption (e.g., hotel, flights), and a detailed explanation of the events.

Travel Insurance and Credit Cards

Many travelers utilize credit cards for their purchases, and some cards offer supplemental travel insurance benefits. Understanding the differences between this built-in coverage and standalone travel insurance policies is crucial for making informed decisions about your travel protection. This section will compare and contrast these options to help you determine which best suits your needs.

Credit card travel insurance and standalone travel insurance policies offer different levels and types of coverage. While credit card insurance can provide a basic level of protection, it often has significant limitations compared to comprehensive standalone policies. Choosing between the two depends largely on the extent of your travel plans and risk tolerance.

Credit Card Travel Insurance Coverage

Credit card travel insurance typically provides limited coverage for trip cancellations or interruptions, lost or delayed baggage, and sometimes emergency medical expenses. The extent of coverage varies significantly depending on the credit card issuer and the specific card. It’s crucial to carefully review your credit card’s terms and conditions to understand exactly what is covered and what is excluded. For instance, some cards might only cover trip cancellations due to specific, limited reasons, such as severe weather impacting the airport, while others might exclude pre-existing medical conditions. Coverage amounts are also generally lower than those offered by standalone policies. The process for filing a claim is also typically handled through the credit card company, which may have different procedures and requirements than those of a standalone insurance provider.

Standalone Travel Insurance Policies

Standalone travel insurance policies offer more comprehensive coverage than most credit card options. They usually cover a wider range of situations, including trip cancellations for various reasons (illness, job loss, etc.), medical emergencies with higher coverage limits, lost or stolen belongings, and emergency evacuation. These policies often provide 24/7 emergency assistance services, offering support with medical referrals, lost document replacement, and other travel-related emergencies. Furthermore, standalone policies allow for customization, enabling travelers to select the level of coverage that best aligns with their trip’s specifics and risk assessment. While the premiums for standalone policies are higher than the implicit cost of credit card insurance, the increased coverage and broader protection often justify the expense for travelers concerned about significant financial losses due to unforeseen events.

Situations Where Credit Card Coverage Might Suffice

Credit card travel insurance might be sufficient for short trips with minimal expenses and low risk. For example, a weekend getaway to a nearby city might only require basic coverage for trip cancellation due to unforeseen circumstances or lost luggage. However, even in such scenarios, carefully reviewing the credit card’s terms and conditions is vital to ensure the coverage aligns with the trip’s specific needs.

Situations Where Credit Card Coverage Would Be Insufficient

Credit card travel insurance is often inadequate for extensive or expensive trips, especially those involving adventure activities or travel to remote locations. For instance, a multi-week backpacking trip through Southeast Asia would require significantly more comprehensive medical coverage and emergency evacuation capabilities than what a typical credit card offers. Similarly, a luxury cruise or an expensive safari would benefit from a standalone policy with higher coverage limits for lost or damaged belongings. Travelers with pre-existing medical conditions also generally need a standalone policy, as credit card coverage often excludes such conditions. In situations involving significant financial investment in a trip, a standalone policy provides a much higher level of protection against unforeseen events.

Important Considerations Before and During Travel

Planning ahead and taking proactive steps before and during your trip are crucial for maximizing the benefits of your travel insurance. Understanding your policy and knowing how to handle unexpected events will ensure a smoother and less stressful travel experience. This section details essential actions to take to protect yourself and your investment.

Proper preparation before your trip is paramount in ensuring your travel insurance provides the necessary coverage. Failing to follow certain procedures can invalidate your claim, even if an unforeseen event occurs.

Pre-Trip Checklist for Travel Insurance

It is essential to review your policy documents thoroughly before departure. This includes understanding the extent of your coverage, any limitations or exclusions, and the claims process. A pre-trip checklist can help you stay organized and avoid potential problems.

- Confirm your policy details, including coverage amounts, deductibles, and emergency contact information.

- Make copies of your passport, visa (if applicable), itinerary, and insurance policy documents. Store these copies separately from the originals, ideally in a cloud-based storage service and with a trusted person not traveling with you.

- Notify your bank and credit card companies of your travel dates and destinations to avoid any issues with card usage.

- Ensure all necessary vaccinations and health precautions are up to date. Documentation of these is advisable.

- Pack appropriately for your destination and activities, including any necessary medications.

- Register your trip with your embassy or consulate, if recommended for your destination.

Handling Unexpected Situations During Travel

Unexpected events, such as flight delays, lost luggage, or medical emergencies, can disrupt your travel plans. Knowing how to react and whom to contact is crucial.

- In case of a medical emergency, seek immediate medical attention. Document all medical expenses, including receipts and doctor’s notes.

- Report any incidents, such as lost luggage or trip cancellations, to the relevant authorities (airline, hotel, etc.) and obtain documentation for your claim.

- Contact your travel insurance provider as soon as possible to report the incident and follow their instructions for filing a claim. Keep detailed records of all communication.

- Keep copies of all relevant documents, such as receipts, police reports (if applicable), and correspondence with your insurance provider.

- Understand the process of submitting your claim and gather all the necessary documentation before doing so. Timely submission is important.

Contacting Your Insurance Provider

Your travel insurance policy should provide clear contact information for emergency assistance and claims processing. Familiarize yourself with these details before your departure. Typically, this involves a 24/7 emergency assistance hotline.

Remember to keep your policy documents readily accessible during your trip, either physically or digitally.

FAQ Overview

Travel Insurance FAQs: What Every Traveler Should Know – What is the difference between travel insurance and travel assistance?

Travel insurance covers financial losses due to unforeseen events like trip cancellations or medical emergencies. Travel assistance provides services like emergency medical evacuation or lost luggage support.

Can I buy travel insurance after my trip has started?

Generally, no. Most policies require purchase before your departure date. Some offer limited “single trip” options with restrictions.

What if I need to cancel my trip due to a family emergency?

Most comprehensive policies cover trip cancellations due to family emergencies, but you will need to provide supporting documentation.

Does travel insurance cover pre-existing conditions?

Coverage for pre-existing conditions varies widely. Some policies offer limited coverage if the condition is declared before purchase and you meet specific criteria. Others may exclude them entirely.

How long does it take to process a travel insurance claim?

Processing times vary depending on the insurer and the complexity of the claim. Allow several weeks, and keep track of your claim status.