Term Life vs. Whole Life Insurance Which is Best?

Defining Term Life and Whole Life Insurance

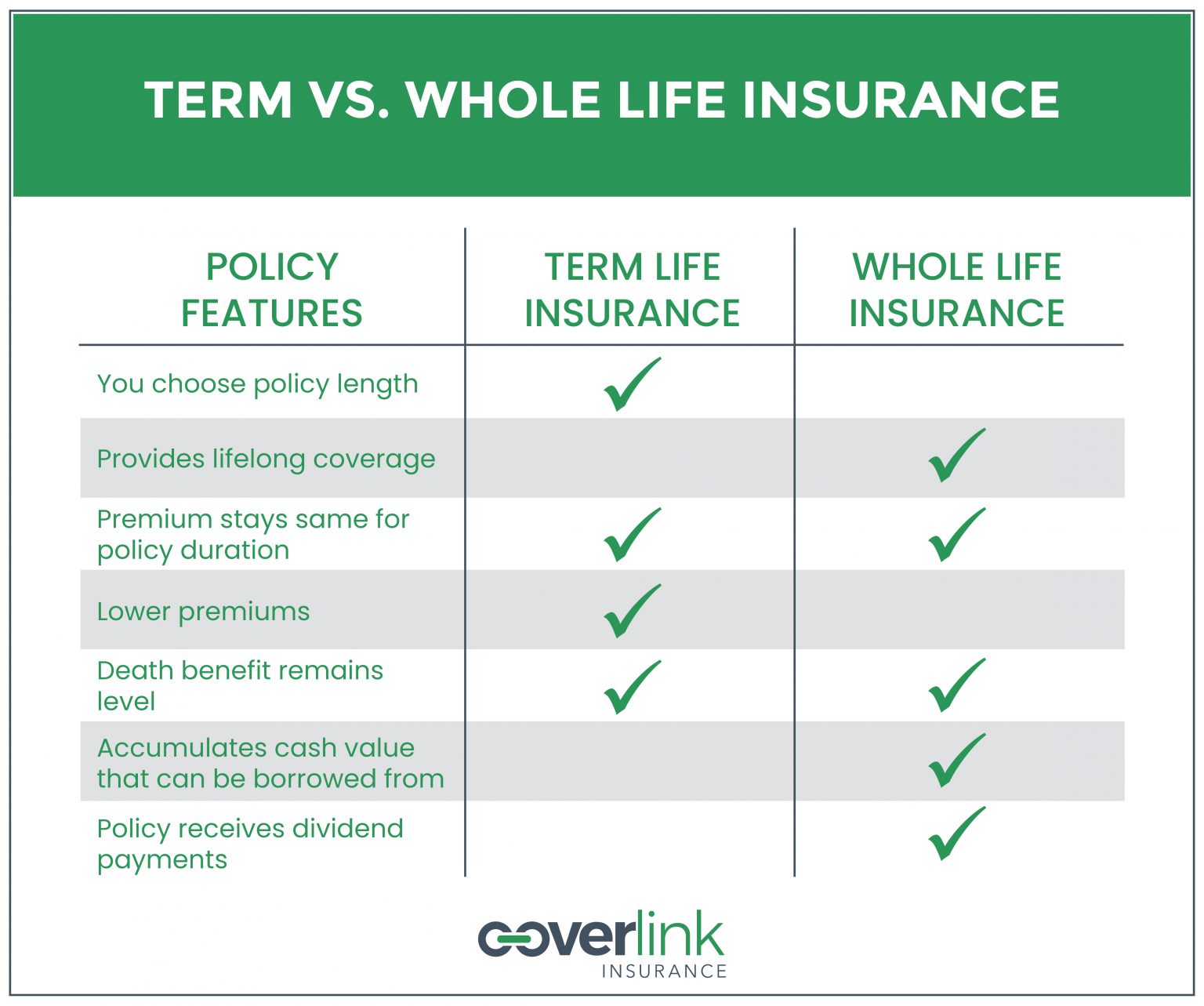

Choosing the right life insurance policy can significantly impact your financial security and the future of your loved ones. Understanding the core differences between term life and whole life insurance is crucial for making an informed decision. This section will define each type of policy and highlight their key characteristics.

Term life insurance and whole life insurance represent two distinct approaches to life insurance coverage. They differ fundamentally in their coverage duration, cost structure, and the presence or absence of a cash value component.

Term Life Insurance Definition

Term life insurance provides coverage for a specified period, or “term,” typically ranging from 10 to 30 years. It’s a straightforward, affordable option that offers a death benefit if the insured dies within the policy’s term. If the insured survives the term, the policy expires, and no further coverage is provided unless renewed, often at a higher premium. Key features include a fixed premium for the policy term and a relatively low cost compared to whole life insurance. The policy’s primary purpose is to provide a death benefit to beneficiaries during the term of coverage.

Whole Life Insurance Definition

Whole life insurance, in contrast, offers lifelong coverage, as long as premiums are paid. Besides providing a death benefit, it also builds a cash value component that grows tax-deferred over time. This cash value can be borrowed against or withdrawn, although doing so will reduce the death benefit and may incur penalties. Whole life policies typically have higher premiums than term life policies due to the lifelong coverage and cash value accumulation. The policy’s dual purpose is to provide a death benefit and a savings vehicle.

Comparison of Term Life and Whole Life Insurance

The most significant difference lies in the duration of coverage. Term life insurance offers temporary coverage for a specific period, while whole life insurance provides lifelong coverage. Term life insurance is generally more affordable, making it a suitable option for those seeking temporary coverage, such as during periods of high financial responsibility like raising a family or paying off a mortgage. Whole life insurance, while more expensive, offers lifelong protection and a cash value component that can serve as a long-term savings and investment tool. The choice between the two depends heavily on individual financial goals, risk tolerance, and long-term planning needs.

Cost Comparison

Understanding the cost differences between term and whole life insurance is crucial for making an informed decision. While both offer death benefit protection, their premium structures and long-term expenses vary significantly. This section details the typical cost profiles for each type, allowing for a clearer comparison of overall financial implications.

Term Life Insurance Premiums

Term life insurance premiums are generally lower than whole life premiums, especially for younger individuals. The cost is primarily determined by the applicant’s age, health, the desired death benefit amount, and the policy’s length (term). Younger, healthier individuals typically receive lower premiums because they pose a lower risk to the insurance company. As the insured ages, the premiums increase at each renewal period, reflecting the higher risk of mortality. For example, a 30-year-old purchasing a $500,000, 20-year term policy might pay significantly less annually than a 50-year-old purchasing the same coverage. The premium increases are usually substantial when renewing a term life policy, often doubling or tripling the initial premium if renewal is even possible.

Whole Life Insurance Premiums

Whole life insurance premiums remain level throughout the policy’s duration, providing predictable monthly or annual payments. However, these premiums are typically significantly higher than term life insurance premiums for comparable coverage amounts. The higher cost reflects the fact that whole life insurance offers a cash value component that grows over time, in addition to the death benefit. Similar to term life, age and health status influence premium amounts; a younger, healthier individual will typically receive a lower premium than an older, less healthy applicant. However, unlike term life, whole life premiums do not increase with age. The cost is usually fixed for the entire life of the policy.

Cost Comparison over 20 Years

Comparing the total cost over a 20-year period requires considering both the initial premiums and any potential premium increases. For term life insurance, the cost will increase substantially at each renewal. A 30-year-old might pay relatively low premiums initially, but these premiums could become prohibitively expensive by age 50 if renewal is possible. Whole life insurance, on the other hand, maintains a consistent premium throughout the 20 years, leading to a more predictable total cost. However, this consistent premium is generally much higher than the initial premium for a comparable term life policy. The overall cheaper cost of term life insurance over a 20-year period is often offset by the lack of coverage after the term expires, unless renewed at a much higher cost. The consistent higher cost of whole life insurance provides lifelong coverage.

Average Annual Premiums Comparison

The following table illustrates the average annual premiums for both term and whole life insurance for various coverage amounts and age groups. These are illustrative examples and actual premiums will vary based on individual factors like health and lifestyle.

| Coverage Amount | Age 30 – Term Life | Age 30 – Whole Life | Age 50 – Term Life (Renewal) |

|---|---|---|---|

| $250,000 | $200 | $800 | $800 |

| $500,000 | $400 | $1600 | $1600 |

| $1,000,000 | $800 | $3200 | $3200 |

Death Benefit and Coverage

Understanding the death benefit is crucial when comparing term and whole life insurance. Both policies offer a payout upon the death of the insured, but the nature and structure of this payout differ significantly, impacting the overall value and suitability of each policy type for different individuals and financial situations.

Term Life Insurance Death Benefit

Term life insurance provides a death benefit only if the insured dies within the specified policy term. The death benefit is a fixed amount, stated in the policy, payable to the named beneficiary upon the insured’s death during the term. If the insured survives the term, the policy expires, and no death benefit is paid. For example, a 20-year, $500,000 term life insurance policy will pay out $500,000 to the beneficiary only if the insured dies within those 20 years. No payout occurs if the insured lives beyond the 20-year term.

Whole Life Insurance Death Benefit

Whole life insurance offers a death benefit that remains in effect for the insured’s entire lifetime, provided premiums are paid as scheduled. The death benefit is typically a fixed amount, although some policies may offer increasing death benefits over time. Unlike term life insurance, the death benefit is guaranteed to be paid out eventually upon the insured’s death, regardless of when it occurs. For instance, a $250,000 whole life policy will pay out $250,000 to the beneficiary whenever the insured passes away, even if it’s 50 years after the policy’s inception.

Death Benefit Comparisons Under Various Scenarios

The choice between term and whole life insurance significantly impacts the death benefit payout under different circumstances.

| Scenario | Term Life ($500,000, 20-year term) | Whole Life ($250,000) |

|---|---|---|

| Insured dies within the term (15 years) | $500,000 payout | $250,000 payout |

| Insured dies after the term (25 years) | $0 payout | $250,000 payout |

| Insured lives beyond the term (30 years) | $0 payout | $250,000 payout (at death) |

This comparison highlights that term life insurance provides higher coverage for a shorter period at a lower premium, while whole life offers lifelong coverage but at a significantly higher cost and a potentially lower death benefit.

Implications of Choosing a Lower versus Higher Death Benefit

The death benefit amount directly impacts the financial security provided to beneficiaries upon the insured’s death. A higher death benefit provides greater financial protection, potentially covering outstanding debts, funeral expenses, and ongoing living expenses for dependents. However, a higher death benefit also translates to higher premiums. Choosing a lower death benefit reduces premiums but limits the financial protection offered to beneficiaries. The optimal death benefit amount depends on individual circumstances, including family size, financial obligations, and risk tolerance. For example, a young couple with a mortgage and young children might prioritize a higher death benefit, even with higher premiums, to ensure their family’s financial security in the event of an unexpected death. Conversely, a single individual with few financial obligations might opt for a lower death benefit to reduce premium costs.

Cash Value and Investment Growth

Whole life insurance distinguishes itself from term life insurance through its cash value component. This feature acts as a savings account that grows over time, offering policyholders a potential source of funds in addition to the death benefit. Understanding how this cash value accumulates and compares to other investment options is crucial for determining whether whole life insurance aligns with your financial goals.

The cash value in a whole life policy grows primarily through the accumulation of premiums and investment earnings. A portion of each premium payment contributes to the cash value, while the remaining portion covers the cost of insurance. The insurance company invests the accumulated cash value, typically in a mix of low-risk securities. The growth rate depends on the insurance company’s investment performance and the type of policy. Some policies offer higher growth potential but may also carry higher risk. This growth is generally tax-deferred, meaning you won’t pay taxes on the earnings until you withdraw them.

Factors Influencing Cash Value Growth

Several factors significantly influence the rate at which cash value grows within a whole life insurance policy. The most prominent is the interest rate credited to the cash value account. Insurance companies typically declare an interest rate annually, and this rate can fluctuate based on market conditions and the insurer’s investment strategy. Additionally, the premiums paid, the policy’s cash value accumulation method (e.g., interest only or interest plus dividends), and the policy fees and expenses all directly impact the net growth of the cash value. Higher premiums naturally lead to faster cash value growth, assuming all other factors remain constant. However, it is crucial to consider the overall cost of the policy, including fees, when assessing its value proposition.

Whole Life Insurance vs. Other Investment Vehicles

Whole life insurance’s cash value component offers a different investment profile compared to other vehicles such as stocks, bonds, or mutual funds. While it provides tax-deferred growth, the returns are generally lower and less volatile than those of higher-risk investments. The growth is often guaranteed to a minimum level, offering a degree of security not present in more speculative investments. For example, a stock portfolio might experience significant fluctuations, potentially resulting in both substantial gains and losses, whereas a whole life policy’s cash value tends to grow at a steadier, though potentially slower, pace. The choice between whole life insurance and other investments depends heavily on individual risk tolerance and financial objectives. Someone seeking aggressive growth might find whole life insurance less appealing than a diversified stock portfolio, while someone prioritizing security and tax-deferred growth might find it more attractive.

Tax Advantages and Disadvantages of Cash Value Accumulation

A key advantage of whole life insurance’s cash value is the tax-deferred growth. This means that you will not pay taxes on the investment earnings until you withdraw them. However, withdrawals may be subject to taxes and potentially penalties, depending on factors such as your age and the amount withdrawn relative to the premiums paid. For instance, withdrawing funds before age 59 1/2 might incur a 10% early withdrawal penalty in addition to income tax on the withdrawn amount. Conversely, loans taken against the cash value are generally not taxed, although interest accrues and reduces the eventual death benefit. It’s crucial to understand these tax implications before making any withdrawals or loans against the cash value. Proper financial planning can help you utilize the tax advantages while minimizing potential tax liabilities.

Policy Flexibility and Renewability

Choosing between term life and whole life insurance often hinges on the flexibility each policy offers. Understanding the renewability options and adaptability of coverage is crucial for making an informed decision that aligns with your evolving life circumstances. Both types of insurance provide coverage, but their approaches to flexibility differ significantly.

Term life insurance and whole life insurance offer contrasting levels of flexibility regarding policy adjustments and renewal. While term life insurance provides straightforward, albeit limited, options, whole life insurance offers a wider range of choices, though often at a higher cost. The best choice depends on your individual needs and long-term financial planning.

Term Life Insurance Renewability

Term life insurance policies are temporary contracts, offering coverage for a specific period (term), such as 10, 20, or 30 years. At the end of the term, the policy expires. However, many term life policies include a renewability option. This allows the policyholder to renew the coverage for another term, usually at a higher premium. The increased premium reflects the insured’s increased age and higher risk profile. The renewal is generally guaranteed, meaning the insurer cannot refuse to renew, though the premium will reflect the new risk assessment. The ability to renew is a key benefit, offering continued coverage even after the initial term ends, although at a potentially significant cost increase. This makes it crucial to carefully consider the long-term implications of renewal before purchasing a term life policy.

Whole Life Insurance Flexibility

Whole life insurance policies, in contrast to term life, offer greater flexibility regarding premium payments and coverage adjustments. Policyholders often have the option to pay premiums in various ways, such as annually, semi-annually, quarterly, or monthly. Some policies even allow for temporary premium suspensions under specific circumstances, although this might impact the policy’s cash value accumulation. Furthermore, many whole life policies allow for adjustments to the death benefit, though this often requires a formal application and may influence the premium amount. The ability to adjust the death benefit can be particularly beneficial as your financial needs change, allowing you to increase or decrease the coverage to align with your circumstances.

Comparing Ease of Coverage Modification

Modifying a term life insurance policy is generally simpler than modifying a whole life policy. Renewing a term life policy typically involves a straightforward process, often requiring only a simple application and payment of the increased premium. Changing coverage in a whole life policy, however, might involve more complex procedures, potentially including medical examinations or adjustments to the cash value component. The complexity of the modification process is often directly related to the increased flexibility offered by whole life insurance. The simplicity of term life policy changes reflects its more limited scope of options.

Examples of Beneficial Policy Flexibility

Consider a scenario where a young couple purchases a 20-year term life policy to cover their mortgage. As their children grow older and their financial responsibilities shift, they might find the need to increase their coverage. With a term life policy, they could renew it for another term, but at a significantly higher cost. In contrast, a whole life policy might allow them to adjust their death benefit to reflect their evolving needs without needing to purchase a completely new policy.

Another example is an individual who experiences a period of financial hardship. A whole life policy may offer more flexibility with premium payments, allowing for temporary suspension or adjustments to the payment schedule. A term life policy, on the other hand, usually requires consistent premium payments, and failure to make timely payments could result in policy lapse. These examples illustrate the benefits of increased flexibility offered by whole life policies in adapting to unforeseen circumstances or changing financial situations.

Suitability for Different Life Stages

Choosing between term and whole life insurance depends heavily on your current life stage and financial goals. Both offer valuable protection, but their suitability varies significantly depending on your individual circumstances and priorities. Understanding these differences is crucial for making an informed decision.

Term life insurance and whole life insurance serve distinct purposes and cater to different needs across various life stages. While term life insurance provides affordable coverage for a specific period, whole life insurance offers lifelong protection alongside a cash value component. This section will examine how these differences affect their suitability at different points in a person’s life.

Term Life Insurance for Young Families with Growing Financial Obligations

Young families often face significant financial responsibilities, including mortgages, childcare, and education expenses. Term life insurance offers an economical way to secure a substantial death benefit during these high-need years. The premiums are relatively low compared to whole life, allowing families to maximize coverage within their budget. If the primary breadwinner passes away, the death benefit can provide financial security for the family, ensuring the children’s education and the mortgage are covered. For example, a young couple with a new baby might opt for a 20-year term policy to cover the mortgage and childcare costs until the children are older and more financially independent. The affordability of term life makes it a practical choice for this demographic, allowing them to focus on building their financial future without the added expense of a whole life policy.

Whole Life Insurance for Individuals Nearing Retirement

As individuals approach retirement, their financial priorities shift. While the need for a substantial death benefit remains, the focus often moves towards securing a legacy and providing for long-term care expenses. Whole life insurance becomes more appealing at this stage because of its lifelong coverage and cash value accumulation. The cash value can serve as a supplemental retirement income source or a safety net for unexpected medical costs. For instance, a 60-year-old nearing retirement might find the cash value component of a whole life policy valuable for supplementing their pension or covering potential long-term care needs. The guaranteed lifelong coverage offers peace of mind, knowing that their loved ones will be protected regardless of their age or health.

Comparison of Policy Types for Different Financial Goals and Life Circumstances

The appropriateness of term versus whole life insurance depends heavily on individual financial goals and circumstances. A young, healthy individual with a limited budget and a short-term need for coverage might find term life insurance perfectly suitable. Conversely, someone with a higher income, long-term financial goals, and a desire for lifelong coverage and cash value accumulation might prefer whole life insurance. Those prioritizing affordability and coverage for a specific period, like paying off a mortgage, will benefit more from term life. Those who value guaranteed lifelong protection and the potential for cash value growth will likely prefer whole life. The decision is a personalized one, requiring a careful consideration of one’s financial resources, risk tolerance, and long-term objectives.

- Ideal Life Stages for Term Life Insurance: Young adults, newlyweds, families with young children, individuals with short-term coverage needs (e.g., paying off a mortgage).

- Ideal Life Stages for Whole Life Insurance: Individuals with higher incomes seeking long-term coverage and cash value growth, those nearing retirement who want supplemental income and legacy planning.

Understanding Policy Riders and Add-ons

Policy riders and add-ons offer valuable opportunities to customize life insurance policies, enhancing coverage and tailoring them to specific individual needs and circumstances. They provide additional benefits beyond the core policy’s death benefit, often at an added cost. Understanding the available riders and their implications is crucial for making an informed decision about which policy best suits your circumstances.

Term Life Insurance Policy Riders

Several riders can augment the basic death benefit of a term life insurance policy. These riders typically come with an additional premium. Choosing the right riders depends on your individual risk profile and financial goals.

Common riders for term life insurance policies include:

- Accidental Death Benefit Rider: This rider pays an additional sum if the insured dies due to an accident. For example, if the death benefit is $500,000 and the accidental death benefit rider is 50%, an additional $250,000 would be paid to the beneficiary in case of accidental death.

- Waiver of Premium Rider: This rider waives future premiums if the insured becomes totally disabled. This ensures the policy remains in force even if the insured can no longer afford the premiums due to disability.

- Term Conversion Rider: This rider allows the policyholder to convert their term life insurance policy to a permanent policy (like whole life) without undergoing a new medical examination, typically within a specified time frame. This is valuable if circumstances change and a permanent policy becomes more desirable.

Whole Life Insurance Policy Riders

Whole life insurance policies, being permanent, offer a wider range of riders to further customize coverage and benefits. These riders can significantly enhance the policy’s value and flexibility.

Common riders for whole life insurance policies include:

- Accidental Death Benefit Rider: Similar to term life, this rider pays an additional death benefit in case of accidental death. The additional benefit amount is usually a percentage of the face value of the policy.

- Waiver of Premium Rider: This rider functions identically to the term life waiver of premium rider, ensuring the policy continues even if the insured becomes disabled and cannot afford premiums.

- Guaranteed Insurability Rider: This allows the policyholder to purchase additional life insurance coverage at predetermined intervals without providing proof of insurability. This is valuable as health conditions can change over time, making it more difficult to obtain additional insurance later.

- Long-Term Care Rider: This rider provides funds for long-term care expenses, such as nursing home care, should the insured need it. This can help preserve assets and avoid depleting savings to pay for long-term care.

Cost and Value Comparison of Riders

The cost of riders varies significantly depending on the insurer, the type of policy, the rider itself, and the insured’s age and health. Generally, riders for whole life insurance tend to be more expensive than those for term life insurance because of the longer coverage period and potential for additional benefits. However, the value of a rider is subjective and depends on the individual’s risk tolerance and specific needs. For instance, a waiver of premium rider might be invaluable for someone with a higher risk of disability, justifying the extra cost. A long-term care rider, while expensive, might be a cost-effective way to plan for potential long-term care needs, preventing the depletion of personal assets.

Enhancing Coverage and Tailoring Policies

Riders provide a powerful way to customize life insurance to precisely match individual circumstances. For example, a young, healthy individual might opt for a term life policy with an accidental death benefit rider, prioritizing affordability and coverage for unexpected events. An older individual with significant assets might choose a whole life policy with a long-term care rider, focusing on long-term care planning and asset protection. Careful consideration of individual needs and risk profiles is crucial in selecting appropriate riders to maximize the value and benefits of the life insurance policy.

Factors Influencing Policy Selection

Choosing between term and whole life insurance requires careful consideration of several key factors. The best option depends heavily on your individual circumstances, financial goals, and risk tolerance. Understanding these factors will help you make an informed decision that aligns with your needs and priorities.

Individual Financial Circumstances

Your current financial situation plays a crucial role in determining the most suitable type of life insurance. Factors such as your income, existing savings and investments, outstanding debts (like mortgages or loans), and the number of dependents significantly influence your insurance needs. For example, a young family with a significant mortgage might prioritize a lower-cost term life insurance policy to provide adequate coverage during their highest-earning years, while a high-net-worth individual with substantial assets might find whole life insurance’s cash value accumulation beneficial for long-term wealth planning. Analyzing your budget and determining how much you can comfortably afford in premiums is paramount. A realistic assessment of your financial resources will help you avoid overspending on insurance premiums and ensure you have sufficient coverage.

Risk Tolerance

Risk tolerance refers to your comfort level with uncertainty and potential financial losses. Individuals with a higher risk tolerance might prefer term life insurance, accepting the possibility of needing to renew or replace the policy later, while prioritizing affordability in the present. Conversely, those with a lower risk tolerance might favor the guaranteed lifelong coverage of whole life insurance, even at a higher premium cost, prioritizing the peace of mind it offers. Consider your overall investment strategy and comfort level with market fluctuations. Whole life insurance, while offering a cash value component, is still subject to the insurance company’s performance. This should be weighed against the simpler, more predictable nature of term life insurance premiums.

Long-Term Financial Planning

Your long-term financial goals and objectives heavily influence the choice between term and whole life insurance. If your primary goal is to provide coverage for a specific period, such as until your children are financially independent or your mortgage is paid off, term life insurance may suffice. However, if you envision using life insurance as a long-term savings vehicle or as part of a comprehensive estate plan, the cash value accumulation feature of whole life insurance could be a more suitable option. For example, a family aiming to leave a substantial inheritance might find whole life insurance’s cash value growth beneficial in supplementing their estate, while a young couple focusing solely on debt reduction might opt for term life insurance to address their immediate needs. A thorough financial plan considering retirement goals, legacy planning, and potential tax implications is essential for making an informed decision.

Illustrative Scenarios and Case Studies

Understanding the differences between term and whole life insurance can be challenging. Real-life scenarios can help clarify which type of policy best suits individual needs and financial goals. The following examples illustrate the advantages of each policy under different circumstances.

Term Life Insurance for a Young Professional

Sarah, a 28-year-old software engineer, recently purchased a home and is starting a family. Her primary financial concern is protecting her family in the event of her untimely death, while her current budget is tight. A 20-year term life insurance policy provides her with substantial coverage (e.g., $500,000) at a relatively low premium, ensuring her family’s financial stability during the mortgage repayment period and her children’s formative years. The affordability of term life allows Sarah to allocate her financial resources towards other important goals, such as saving for retirement or her children’s education, without sacrificing crucial life insurance protection. If, after 20 years, her financial situation changes, she can re-evaluate her insurance needs and choose a different policy or renew her term life insurance.

Whole Life Insurance for a Business Owner

Mark, a 45-year-old successful entrepreneur, owns a thriving small business. He is concerned about his business’s long-term financial stability and his family’s future. A whole life insurance policy offers him a death benefit to protect his business and family, while the cash value component acts as a long-term savings and investment vehicle. Mark uses the policy’s cash value to secure business loans, providing needed capital for expansion. He also plans to use the cash value as a supplemental retirement income source, leveraging the tax advantages associated with whole life insurance. The consistent, guaranteed growth of the cash value provides Mark with financial security and peace of mind, knowing that his business and family are protected even beyond his working years.

Comparison of Scenarios

Sarah’s situation highlights the benefits of term life insurance’s affordability and high coverage for a specific period. Her focus is on temporary protection during a high-risk period, aligning with the temporary nature of term life insurance. Mark’s scenario, on the other hand, showcases the advantages of whole life insurance’s long-term financial planning capabilities and the combination of death benefit and cash value accumulation. His need for permanent coverage and a long-term savings vehicle makes whole life insurance a suitable choice. The differing financial goals and risk profiles of Sarah and Mark illustrate how the best type of life insurance policy depends heavily on individual circumstances. Both individuals benefit from their chosen policy, demonstrating the importance of selecting a policy that aligns with personal needs and financial objectives.

Finding the Right Insurance Provider and Agent

Choosing the right life insurance provider and agent is crucial for securing the best policy at a fair price. A well-informed decision requires careful research and consideration of several factors beyond simply the lowest premium. This section provides guidance on navigating this important process.

Finding a reputable insurance provider involves more than just looking for the cheapest option. It’s essential to assess the financial stability and reputation of the company. A provider’s history of claims payouts and customer service ratings can offer valuable insights into their reliability.

Reputable Insurance Provider Selection Criteria

Several key factors should guide your selection of a life insurance provider. Consider the company’s financial strength ratings from independent agencies like A.M. Best, Moody’s, and Standard & Poor’s. These ratings assess a company’s ability to pay claims. Additionally, review customer reviews and complaints filed with state insurance departments to gauge the provider’s customer service and claims handling processes. Look for a company with a long history of stability and positive customer feedback. A strong financial rating combined with positive customer reviews indicates a reliable provider.

Selecting an Unbiased Insurance Agent

An experienced and unbiased insurance agent can be invaluable in navigating the complexities of life insurance. Independent agents, who represent multiple insurance companies, offer a broader range of options compared to captive agents who only represent a single company. Seek recommendations from trusted sources like friends, family, or financial advisors. Verify the agent’s credentials and licensing information through your state’s insurance department. A thorough agent will take the time to understand your individual needs and provide personalized recommendations rather than pushing specific products.

Comparing Quotes from Multiple Providers

Obtaining quotes from multiple providers is essential for comparison shopping. Don’t solely focus on the premium; consider the overall value, including the death benefit, policy features, and the provider’s financial stability. Use online comparison tools and contact multiple agents directly to gather a comprehensive range of options. This comparative analysis ensures you’re not overpaying for your coverage and that you’re getting the features that best suit your circumstances. For example, comparing a quote from a large, established company with a quote from a smaller, newer company can highlight significant differences in price and coverage features.

Key Questions for Insurance Providers and Agents

Before committing to a policy, ask potential providers and agents several critical questions. Inquire about the provider’s financial strength ratings and claims-paying history. Ask about the policy’s features, including riders and exclusions. Clarify the policy’s renewal terms and any potential increases in premiums. Discuss the agent’s compensation structure to ensure transparency and avoid potential conflicts of interest. Finally, ask about the provider’s customer service processes and how claims are handled. For instance, you might ask: “What is your company’s claim approval process and average processing time?” or “What is your agent’s commission structure for this policy?” Thorough questioning helps ensure you understand the policy’s terms and conditions completely.

Q&A

What is the average length of a term life insurance policy?

Term life insurance policies typically range from 10 to 30 years, although shorter and longer terms are available.

Can I convert a term life insurance policy to a whole life policy?

Some term life insurance policies offer a conversion option, allowing you to switch to a whole life policy without a medical exam, usually within a specific timeframe.

What factors influence the cost of whole life insurance premiums?

Factors affecting whole life insurance premiums include age, health, policy type (e.g., participating vs. non-participating), and the death benefit amount.

What happens to the cash value in a whole life policy if I cancel it?

If you cancel a whole life policy, you’ll typically receive the accumulated cash value, minus any surrender charges that may apply.