How Hotel Cancellation Policies Affect Your Travel Insurance

Understanding Hotel Cancellation Policies

Hotel cancellation policies are crucial for both travelers and hotels. Understanding these policies before booking is essential to avoid unexpected costs and ensure a smooth travel experience. These policies Artikel the terms and conditions under which a reservation can be canceled and what, if any, penalties apply.

Typical Components of a Hotel Cancellation Policy

A typical hotel cancellation policy will specify a cancellation deadline, the methods for canceling a reservation (e.g., phone, email, online portal), and the associated fees or penalties for cancellations made before or after the deadline. The policy may also address situations such as no-shows and early departures. Some policies might offer flexibility depending on the booking type, the hotel’s occupancy rate, and the specific time of year. It is vital to carefully read the entire policy to avoid misunderstandings.

Refundable and Non-Refundable Bookings

The most significant difference between refundable and non-refundable bookings lies in the ability to receive a refund upon cancellation. Refundable bookings allow for a full or partial refund if canceled before the specified deadline, while non-refundable bookings typically forfeit the entire payment regardless of the cancellation timing. The terms “refundable” and “non-refundable” are often explicitly stated during the booking process. The amount refunded, in the case of refundable bookings, can vary based on the specific policy and the time of cancellation. For instance, a cancellation made within 24 hours might incur a small fee, while a cancellation made several days before arrival might receive a full refund.

Examples of Cancellation Policy Scenarios

Several scenarios illustrate the range of cancellation policies:

- Free Cancellation: The guest can cancel their reservation without incurring any fees up to a specified date (e.g., 24 hours before arrival).

- Cancellation with Fees: The guest can cancel their reservation, but they will incur a fee (e.g., one night’s stay, a percentage of the total cost) if the cancellation is made after a specific deadline.

- No Cancellation: The guest cannot cancel their reservation under any circumstances without forfeiting the entire payment. This is commonly found in non-refundable bookings, often offering a lower price in exchange for the lack of flexibility.

Comparison of Cancellation Policy Types

The following table summarizes the key differences between various cancellation policy types:

| Policy Type | Cancellation Deadline | Cancellation Fee | Refund |

|---|---|---|---|

| Free Cancellation | Specified date (e.g., 24 hours before arrival) | None | Full refund if canceled before the deadline |

| Cancellation with Fees | Specified date | Varies (e.g., one night’s stay, percentage of total cost) | Partial refund (total cost minus the fee) if canceled before the deadline |

| No Cancellation | N/A | Full cost of the reservation | No refund |

Travel Insurance Coverage and Cancellation

Travel insurance can offer valuable protection against unforeseen circumstances, including the need to cancel a hotel booking. Understanding the nuances of your policy is crucial to ensure you receive the appropriate compensation should the need arise. This section will clarify the types of coverage available, situations where claims are typically approved, and the process of filing a successful claim.

Travel insurance policies that include trip cancellation coverage often extend this protection to hotel cancellations, provided the cancellation is due to a covered reason. The specific events covered vary between policies, so it’s essential to review your policy wording carefully before relying on this coverage. Many policies also offer trip interruption coverage, which might cover additional hotel costs if your trip is unexpectedly cut short due to a covered event.

Types of Travel Insurance Covering Hotel Cancellations

Comprehensive travel insurance policies generally offer the broadest coverage for hotel cancellations. These policies typically cover cancellations due to a wide range of circumstances, including illness, injury, severe weather, natural disasters, and even terrorism. More basic policies may only cover cancellations resulting from specific, limited events, such as a sudden illness requiring medical attention. Always compare policies to find one that suits your needs and risk tolerance.

Examples of Covered Hotel Cancellation Situations

Several scenarios could justify a claim for hotel cancellation under a travel insurance policy. For example, if a sudden illness prevents you from traveling, a doctor’s note documenting the illness and its severity would support a claim. Similarly, if a hurricane forces the closure of your destination airport, preventing you from reaching your hotel, news reports and flight cancellation confirmations would serve as evidence. If a family emergency necessitates an immediate return home, appropriate documentation such as a death certificate or hospital admission paperwork could substantiate the claim.

Documentation Needed for a Hotel Cancellation Claim

To successfully file a claim, meticulous record-keeping is essential. This includes your travel insurance policy documents, the hotel booking confirmation showing the cancellation details, and evidence supporting the reason for cancellation. Depending on the situation, this supporting evidence might include a doctor’s note, a police report, a death certificate, or official documentation of a natural disaster. The more comprehensive the documentation, the stronger your claim. Be sure to retain all receipts related to the cancelled hotel booking.

Step-by-Step Guide to Filing a Travel Insurance Claim for Hotel Cancellation

- Review your policy: Carefully examine your policy’s terms and conditions to understand the specific coverage for hotel cancellations and the required documentation.

- Notify your insurer: Contact your insurance provider as soon as possible after the cancellation. Many policies require notification within a specific timeframe.

- Gather necessary documentation: Compile all relevant documents, including your policy, booking confirmation, cancellation confirmation, and supporting evidence for the reason for cancellation.

- Submit your claim: Follow your insurer’s instructions for submitting your claim. This typically involves completing a claim form and providing all necessary documentation.

- Follow up: After submitting your claim, follow up with your insurer to inquire about the status of your claim. Keep records of all communication.

Policy Interactions

Understanding the interplay between hotel cancellation policies and travel insurance is crucial for protecting your travel investment. Both documents utilize legal language, but their focus and scope differ significantly, potentially leading to confusion and unexpected financial burdens. This section will highlight key differences and potential ambiguities to help you navigate this complex relationship.

How Hotel Cancellation Policies Affect Your Travel Insurance – Hotel cancellation policies are primarily concerned with the hotel’s financial protection. They typically Artikel specific deadlines for cancellation, the associated fees (often escalating closer to the check-in date), and any exceptions they may offer. Travel insurance policies, conversely, focus on protecting the traveler from unforeseen circumstances that might disrupt their travel plans. They detail the types of events covered (illness, injury, natural disasters, etc.), the extent of coverage, and any limitations or exclusions.

Language Differences and Ambiguities, How Hotel Cancellation Policies Affect Your Travel Insurance

Hotel cancellation policies often use concise, business-oriented language, focusing on deadlines and penalties. For example, a policy might state: “Cancellations made within 72 hours of arrival are subject to a 100% penalty.” In contrast, travel insurance policies tend to be more detailed and legally complex, employing precise definitions and exclusions. A travel insurance policy might state: “Coverage for trip cancellation due to illness is contingent upon the submission of medical documentation from a licensed physician within 14 days of the cancellation date.” Discrepancies can arise when the definition of an “unforeseen circumstance” in the insurance policy doesn’t align with the hotel’s definition of a justifiable cancellation reason. For example, a sudden, unexpected family emergency might be covered by insurance but not deemed a valid reason for a fee waiver by the hotel.

Pre-existing Conditions and Insurance Coverage

Pre-existing medical conditions can significantly impact travel insurance coverage for cancellations. Most policies have waiting periods (typically ranging from 10 to 15 days) before coverage is activated for pre-existing conditions. This means if you cancel a trip due to a pre-existing condition that manifests itself before the waiting period is over, your claim might be denied. Furthermore, even after the waiting period, some policies might limit coverage for pre-existing conditions or require additional documentation, such as a doctor’s statement confirming the condition’s severity and its direct link to the cancellation.

Hypothetical Scenario: Partial Insurance Coverage

Imagine a traveler, Sarah, books a $1000 hotel stay. Her travel insurance policy covers trip cancellations due to illness, with a $250 deductible. Sarah falls ill unexpectedly three days before her trip and requires medical attention, preventing her from traveling. The hotel’s cancellation policy charges a 50% penalty, resulting in a $500 cancellation fee. Sarah submits a claim to her insurance company, providing medical documentation. The insurance company approves the claim, covering $250 (the cancellation fee minus the deductible). Sarah is still responsible for the remaining $250. This illustrates how insurance can provide partial coverage, mitigating some but not all of the financial impact of a hotel cancellation.

Factors Affecting Cancellation Coverage

Understanding the intricacies of travel insurance and how it interacts with hotel cancellation policies requires a nuanced understanding of several key factors. These factors can significantly impact whether your claim is approved and the amount you receive. This section will explore these crucial elements to help you better navigate the process.

Unforeseen Circumstances and Cancellation Claims

Unforeseen circumstances, such as sudden illness, serious injury, or unexpected natural disasters, often form the basis of successful travel insurance cancellation claims. Providing comprehensive documentation is vital. This typically includes medical certificates from a physician, police reports detailing the natural disaster’s impact on your travel plans, or other official documentation proving the unexpected and unavoidable nature of the event. The severity and verifiability of the event directly influence the claim’s success. For example, a minor illness requiring only a day of rest might not qualify for a full refund, whereas a serious medical emergency requiring hospitalization would likely warrant more consideration. Similarly, a hurricane forcing the closure of your destination would be a stronger case than a minor weather disruption.

Cancellation Timing and Claim Outcomes

The timing of your cancellation significantly impacts the claim process and the potential payout. Most travel insurance policies require cancellations to be reported within a specific timeframe, usually within 24-48 hours of the unforeseen event. Delaying notification can jeopardize your claim. Furthermore, the closer to your travel dates you cancel, the less likely you are to receive a full refund, even with valid reasons. This is because the hotel may have already incurred costs associated with your reservation, such as lost revenue from other potential bookings. Early notification allows both the insurance company and the hotel to mitigate losses.

Booking Through Third-Party Platforms and Insurance Coverage

Booking your hotel through a third-party platform, such as Expedia or Booking.com, can introduce complexities to your insurance claim. While your travel insurance should still cover unforeseen circumstances, the claim process might involve additional steps. You may need to involve the platform in the claim process, providing them with documentation of your cancellation and the insurance claim. The platform’s cancellation policy might also impact the amount your insurance company will reimburse, potentially leading to a reduced payout. It’s crucial to review both your insurance policy and the platform’s terms and conditions to understand the potential implications.

Situations Where Cancellation Might Not Be Covered

It’s important to remember that travel insurance does not cover all cancellation scenarios. Common exclusions include cancellations due to: pre-existing medical conditions (unless specifically covered with an additional rider), changes of mind, simple inconvenience, missed flights due to lack of planning or failure to check-in on time, and cancellations made after the policy’s cancellation deadline. Furthermore, some policies exclude cancellations related to political unrest or acts of terrorism unless explicitly stated otherwise. Thoroughly reviewing your policy’s terms and conditions before your trip is crucial to avoid unexpected issues. For example, if you cancel a trip because you simply changed your mind or found a better deal elsewhere, your travel insurance is unlikely to provide coverage.

Reading and Understanding Policy Documents: How Hotel Cancellation Policies Affect Your Travel Insurance

Navigating the fine print of hotel and travel insurance policies can be daunting, but understanding their intricacies is crucial for protecting your travel investment. Careful review of these documents before booking your trip can prevent unexpected costs and frustrations down the line. This section provides guidance on effectively interpreting these policies and identifying key clauses related to cancellations and refunds.

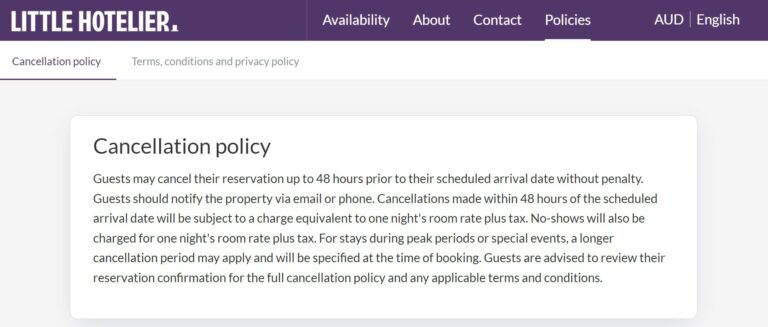

Interpreting Hotel Cancellation Policies

Hotel cancellation policies vary widely, ranging from flexible options with full refunds to strict policies with significant penalties. Key elements to look for include the cancellation deadline, the method for cancelling (phone, email, online portal), and the refund amount or penalty. For example, a policy might state a full refund if cancelled 24 hours prior to arrival, but only a partial refund or no refund if cancelled within 24 hours. Pay close attention to any wording concerning “no-shows,” which usually result in a charge for the entire stay. Look for specific details about what constitutes a valid cancellation, such as providing notification by a certain time or using a specific cancellation method. Always confirm the cancellation policy directly with the hotel before booking to avoid any misunderstandings.

Identifying Key Clauses in Travel Insurance Policies

Travel insurance policies are similarly complex. Focus on sections outlining coverage for trip cancellations and interruptions. Look for specific phrases like “covered reasons for cancellation,” which typically list events such as illness, injury, severe weather, or family emergencies. Examine the policy’s definition of “pre-existing conditions” to understand how they might impact your coverage. Note the limits of coverage, both in terms of the maximum amount payable and any specific exclusions. For instance, some policies might exclude cancellations due to simple changes of mind or events readily foreseeable at the time of booking. Also, pay attention to the claims process, including required documentation and timelines. A well-structured policy will clearly explain the steps involved in filing a claim and the necessary supporting evidence.

Checklist of Questions Before Booking

Before committing to a hotel booking and purchasing travel insurance, consider these key questions:

- What is the hotel’s cancellation policy, including deadlines and refund amounts?

- What are the specific circumstances covered by my travel insurance for trip cancellations and interruptions?

- What documentation is required to file a claim with my travel insurance provider?

- Are there any exclusions or limitations on my travel insurance coverage?

- What is the maximum amount payable under my travel insurance policy for cancellations?

- What is the process for cancelling my hotel reservation and how should I confirm the cancellation?

Understanding Common Travel Insurance Terms

Understanding common terms is vital for interpreting your travel insurance policy accurately. Below are explanations of frequently encountered terms:

- Covered Reason: An event explicitly stated in the policy as grounds for a claim, such as a medical emergency or natural disaster.

- Pre-existing Condition: A medical condition diagnosed or treated before the policy’s effective date. Coverage for pre-existing conditions often requires separate supplemental insurance or may be excluded entirely.

- Deductible: The amount you must pay out-of-pocket before your insurance coverage kicks in.

- Exclusion: Specific events or circumstances that are not covered by the policy.

- Claim: A formal request for payment from your insurance provider after a covered event occurs.

Cost Considerations

Choosing between paying for travel insurance and potentially facing hefty hotel cancellation fees requires a careful evaluation of costs and potential risks. This involves comparing the premium cost of various insurance plans against the possible financial losses from cancelling a hotel reservation. Understanding this balance is crucial for making an informed decision that aligns with your individual travel circumstances and risk tolerance.

The cost of travel insurance varies significantly depending on factors such as trip length, destination, coverage level, and the age of the traveler. Basic plans might cover only medical emergencies, while comprehensive plans offer broader protection, including trip cancellations due to unforeseen circumstances. Hotel cancellation fees, on the other hand, are determined by the hotel’s policy and can range from a small percentage of the total cost to the full amount, depending on the notice period provided.

Comparison of Insurance Premiums and Cancellation Fees

A comprehensive comparison necessitates examining several scenarios. For instance, consider a family planning a week-long trip to Europe. A basic travel insurance policy might cost around $50 per person, offering minimal cancellation coverage. A comprehensive policy, offering broader coverage including cancellation due to illness or unforeseen events, might cost $150 per person. If the hotel cancellation policy charges a 50% penalty for cancellations made within 7 days of arrival, and the total hotel cost is $2000, the cancellation fee would be $1000. In this scenario, the comprehensive insurance, while more expensive upfront, offers significant protection against a substantial financial loss. Conversely, if the family only opts for the basic plan and no unforeseen circumstances arise, they save money on the premium but risk a larger financial loss if cancellation becomes necessary.

Determining the Value of Travel Insurance

The value proposition of travel insurance hinges on assessing the likelihood of needing to cancel a trip versus the cost of the insurance. Several factors play a crucial role in this assessment. Travelers with pre-existing medical conditions or those traveling during hurricane season, for instance, face a higher risk of needing to cancel their trip and would likely benefit from a comprehensive policy. Conversely, a healthy traveler booking a trip during a low-risk period might find a basic policy sufficient, or even decide that the risk of cancellation is low enough to forgo insurance entirely. The decision depends on individual circumstances and risk tolerance.

Cost-Benefit Analysis of Travel Insurance

A cost-benefit analysis can be structured as follows: Calculate the potential cost of hotel cancellation fees (this includes the percentage of the total cost stipulated in the hotel’s cancellation policy). Compare this to the cost of various travel insurance options. Factor in the probability of needing to cancel your trip based on your individual circumstances. For example, a business trip with a high probability of last-minute cancellations would justify a more expensive insurance policy. A leisure trip with a low probability of cancellation might be better served by a less expensive, or even no, travel insurance policy. The analysis will ultimately show whether the potential savings from avoiding cancellation fees outweigh the cost of the insurance premium. The aim is to minimize potential financial losses, balancing the cost of insurance with the potential cost of unforeseen circumstances.

Claim Process and Documentation

Filing a claim with your travel insurance provider for a hotel cancellation requires a systematic approach to ensure a smooth and efficient process. Understanding the necessary steps and documentation will significantly increase your chances of a successful claim. This section details the typical claim process and the supporting documentation you’ll need to provide.

Steps Involved in Filing a Hotel Cancellation Claim

The claim process generally involves several key steps. First, you should review your policy’s specific instructions for filing a claim, as these may vary between providers. Most insurers will require you to submit a claim within a specified timeframe after the cancellation, so prompt action is crucial. Next, gather all necessary documentation, which is discussed in the following section. Then, submit your claim through the insurer’s preferred method, whether online, by mail, or by phone. After submission, you’ll typically receive confirmation of receipt and an estimated processing time. Finally, the insurer will review your claim, and if approved, they will process your reimbursement according to your policy terms.

Necessary Documentation for a Hotel Cancellation Claim

Providing comprehensive documentation is essential for a successful claim. This typically includes the following:

- Hotel Confirmation: A copy of your original hotel booking confirmation, clearly showing the reservation details, dates, cost, and cancellation policy.

- Cancellation Confirmation: Documentation from the hotel confirming the cancellation, including the cancellation date and any associated fees.

- Travel Insurance Policy: A copy of your travel insurance policy document, highlighting the relevant sections covering hotel cancellation.

- Medical Certificate (if applicable): If the cancellation is due to illness or injury, a medical certificate from a doctor detailing the diagnosis, treatment, and the reason why travel was impossible. This certificate should ideally specify the dates of illness or injury.

- Other Supporting Documents: Depending on the circumstances, additional documents might be required, such as flight itinerary changes, police reports (in case of unforeseen circumstances), or other evidence supporting your claim.

Typical Timeline for Processing a Cancellation Claim

The processing time for a travel insurance claim varies depending on the insurer and the complexity of the claim. However, you can generally expect a response within a few weeks to a few months. Simple claims with clear documentation tend to be processed faster. More complex claims requiring further investigation may take longer. For example, a claim involving a medical emergency might require more time for verification of medical documentation. It’s always advisable to contact your insurer to inquire about the status of your claim if you haven’t heard back within the expected timeframe.

Sample Claim Form

Let’s consider a hypothetical scenario: John Doe booked a hotel in Paris for a 7-day trip from October 26th to November 1st. Due to a sudden illness, he had to cancel his trip on October 25th. His travel insurance policy covers trip cancellations due to illness.

| Field | Information |

|---|---|

| Policyholder Name | John Doe |

| Policy Number | 123456789 |

| Claim Date | October 25th, 2024 |

| Reason for Cancellation | Sudden Illness (appendicitis) |

| Hotel Name | Hotel de Paris |

| Reservation Dates | October 26th – November 1st, 2024 |

| Cancellation Date | October 25th, 2024 |

| Total Cost of Hotel | $1000 |

| Amount Claimed | $1000 |

| Supporting Documents Attached | Hotel Confirmation, Cancellation Confirmation, Medical Certificate, Policy Copy |

Choosing the Right Travel Insurance

Selecting the appropriate travel insurance is crucial to mitigate financial losses resulting from unforeseen circumstances, including hotel cancellations. Understanding the nuances of different policies and their coverage for hotel cancellations will empower you to make an informed decision that best protects your travel investment. This section will guide you through the process of comparing policies, considering relevant factors, and identifying reputable providers.

Types of Travel Insurance and Hotel Cancellation Coverage

Travel insurance policies vary significantly in their coverage for hotel cancellations. Basic policies may offer limited coverage, often only for specific, pre-defined reasons such as severe weather or natural disasters. Comprehensive policies, on the other hand, provide broader coverage, including cancellations due to illness, injury, or family emergencies. Some policies even cover cancellations due to unforeseen circumstances at the destination, such as political unrest. It’s essential to carefully review the policy wording to understand the specific events covered and any exclusions. For instance, a policy might exclude cancellations due to a change of mind or simply because a traveler found a better deal.

Factors to Consider When Choosing Travel Insurance

Several factors influence the choice of travel insurance, directly impacting hotel cancellation coverage. Trip length is a significant consideration; longer trips generally require more comprehensive coverage, especially regarding medical emergencies that might necessitate an extended stay or early return home. The destination also plays a vital role. Travel to regions prone to natural disasters or political instability might warrant a policy with broader coverage for unforeseen events. The cost of your trip itself should also factor into your decision; more expensive trips often justify investing in a more comprehensive and higher-coverage policy. Pre-existing medical conditions should be disclosed when purchasing insurance; some policies might offer limited or no coverage for pre-existing conditions unless specific add-ons are purchased.

Finding Reputable Travel Insurance Providers

Choosing a reputable provider is paramount. Look for providers with a proven track record, positive customer reviews, and clear and accessible policy documents. Check if the provider is a member of industry associations, which often indicates adherence to certain standards and best practices. Compare quotes from multiple providers to ensure you’re getting the best value for your needs. Don’t hesitate to contact providers directly with questions about their policies and coverage. Reading independent reviews from sources like consumer protection agencies or travel blogs can offer valuable insights into a provider’s reliability and customer service.

Comparison of Key Features of Various Travel Insurance Plans

The following table compares key features of different travel insurance plans, focusing on hotel cancellation coverage. Remember that these are examples, and specific coverage details vary by provider and policy. Always refer to the policy wording for precise information.

| Plan Name | Hotel Cancellation Coverage | Trip Interruption Coverage | Medical Expense Coverage |

|---|---|---|---|

| Basic Plan | Limited coverage (e.g., natural disasters) | Limited coverage | Limited coverage |

| Standard Plan | Broader coverage (e.g., illness, injury, family emergencies) | Moderate coverage | Moderate coverage |

| Comprehensive Plan | Extensive coverage (including unforeseen circumstances) | Extensive coverage | Extensive coverage |

Prevention and Mitigation Strategies

Minimizing the need to cancel a hotel booking requires proactive planning and a clear understanding of potential disruptions. By implementing several strategies, travelers can significantly reduce their risk and potentially avoid the complexities of cancellation policies and insurance claims. This section details practical steps to achieve this.

Proactive planning and flexible booking options are key to mitigating the risk of hotel cancellations. Understanding your travel plans thoroughly and accounting for potential unforeseen circumstances is crucial. This includes considering factors such as flight delays, unexpected illnesses, or changes in personal circumstances.

Booking Refundable Hotels or Utilizing Flexible Booking Options

Choosing refundable hotel bookings or utilizing flexible booking options provides a crucial safety net. Refundable bookings, as the name suggests, allow for a full or partial refund depending on the cancellation policy’s terms and the timeframe of cancellation. Flexible booking options often offer the ability to change dates or even transfer the booking to another person without penalty, offering greater flexibility should your travel plans alter. For example, booking through a platform that explicitly advertises flexible cancellation options or directly with a hotel that offers a generous cancellation window provides a considerable advantage. This minimizes financial losses in case of unforeseen circumstances that necessitate a change of plans.

Effective Communication with Hotels Regarding Potential Cancellations

Open and timely communication with the hotel is essential if you anticipate needing to cancel your booking. Contacting the hotel as soon as you become aware of a potential cancellation allows them to potentially offer alternative solutions or mitigate any penalties. For instance, if a flight delay is anticipated, informing the hotel promptly might allow them to adjust your check-in time or offer alternative arrangements. Similarly, if illness is the reason for potential cancellation, providing appropriate documentation might influence the hotel’s decision regarding cancellation fees. Direct communication demonstrates responsibility and increases the likelihood of a positive outcome.

Understanding the Cancellation Policy Before Booking

Thoroughly reviewing the hotel’s cancellation policy before making a booking is paramount. This simple step can prevent unexpected financial burdens and disappointments. The cancellation policy will clearly Artikel the deadlines for cancellation, the associated fees, and any exceptions. Paying close attention to the specific terms and conditions will empower you to make an informed decision about the booking, factoring in the potential risks. For example, a non-refundable booking might be suitable for a trip with a low probability of cancellation, while a refundable booking offers greater security for trips with higher uncertainty. This proactive approach significantly reduces the chances of encountering unpleasant surprises later.

Case Studies

This section presents several real-world scenarios to illustrate how hotel cancellation policies and travel insurance coverage interact, impacting travelers’ finances. We will examine diverse situations, highlighting the importance of understanding both your hotel’s policy and your insurance policy’s terms and conditions.

Scenario 1: Unexpected Illness

A traveler booked a non-refundable hotel stay in Paris for a week-long trip. Three days before departure, they fell ill and required hospitalization, preventing them from traveling. Their travel insurance policy included coverage for trip cancellations due to unexpected illness, supported by a doctor’s note. The insurance company reimbursed the full cost of the non-refundable hotel booking, mitigating the financial loss.

Scenario 2: Flight Cancellation

A family booked a fully refundable hotel room in Hawaii. However, their flight was cancelled due to unforeseen circumstances (e.g., a severe weather event). While the hotel offered a full refund, their travel insurance policy did not cover the cost of the canceled flight, only the additional expenses incurred due to the delay or rebooking of flights. Therefore, the family did not file a claim for the hotel.

Scenario 3: Change of Plans

A couple booked a non-refundable hotel stay in Rome. After booking, they decided to change their travel plans entirely, opting for a different destination. Their travel insurance did not cover cancellations due to a change of plans, as this was not considered an unforeseen and unavoidable circumstance. They lost the full cost of the hotel reservation.

Scenario 4: Natural Disaster

A group of friends booked a non-refundable hotel near a beach known for hurricane activity. A hurricane warning was issued shortly before their trip, prompting them to cancel their travel plans. Their travel insurance policy specifically covered cancellations due to natural disasters. The insurance company covered the cost of the hotel, along with other trip expenses affected by the hurricane.

Visual Representation of Outcomes

The following table summarizes the outcomes of the four scenarios:

| Scenario | Hotel Policy | Travel Insurance Coverage | Financial Outcome |

|---|---|---|---|

| Unexpected Illness | Non-refundable | Covered | Full reimbursement |

| Flight Cancellation | Refundable | Not applicable (flight-related) | No loss |

| Change of Plans | Non-refundable | Not covered | Full loss |

| Natural Disaster | Non-refundable | Covered | Full reimbursement |

Question Bank

What happens if my hotel cancels my reservation?

If your hotel cancels your reservation, you may be entitled to a full refund or alternative accommodations, depending on their cancellation policy and local laws. Contact your hotel immediately and review your booking confirmation for details.

Can I use my travel insurance if I change my mind and cancel my trip?

Most travel insurance policies do not cover cancellations due to a change of plans. Coverage typically applies to unforeseen circumstances such as illness, injury, or natural disasters.

What documentation do I need to file a travel insurance claim?

Required documentation varies by insurer, but typically includes your policy details, hotel confirmation, cancellation notice, and supporting evidence related to the reason for cancellation (e.g., medical certificate, official weather report).

How long does it take to process a travel insurance claim?

Processing times vary depending on the insurer and the complexity of the claim. It can range from a few weeks to several months.