What Travel Insurance Wont Cover in Hotel Stays Know Before You Buy

Pre-existing Conditions and Hotel Stays

Travel insurance policies often have limitations regarding pre-existing medical conditions. Understanding these limitations is crucial before embarking on a trip, as a seemingly minor health issue can escalate during travel, leading to significant unforeseen expenses. This section will clarify how pre-existing conditions can impact your hotel stay and your insurance coverage.

Pre-existing conditions refer to any medical issue you had before purchasing your travel insurance policy. These conditions, even if currently managed, can be excluded from coverage if they lead to complications during your trip.

Examples of Pre-existing Conditions and Potential Complications

Many common conditions can fall under this umbrella. For example, asthma, diabetes, heart conditions, and back problems are frequently cited. Let’s consider some scenarios: An individual with poorly controlled asthma might experience a severe attack triggered by allergens in their hotel room, requiring emergency medical attention and hospitalization. Someone with diabetes could experience a hypoglycemic episode due to changes in their routine or diet while traveling. A person with a pre-existing back condition might aggravate their injury from an unsuitable hotel bed, necessitating medical treatment and possibly altering their travel plans. In all these cases, the pre-existing condition is the underlying factor contributing to the need for medical intervention during the hotel stay.

Insurance Response to Pre-existing Condition Complications, What Travel Insurance Won’t Cover in Hotel Stays: Know Before You Buy

Insurance companies generally won’t cover expenses directly related to pre-existing conditions unless specific add-ons or waivers were purchased *before* the policy inception. In the asthma example, the emergency room visit, hospitalization, and medication costs associated with the asthma attack might be denied if asthma was a pre-existing condition not explicitly covered. Similarly, the costs of treatment for a diabetic episode or back injury could be excluded from coverage if the policy explicitly states exclusion for these conditions. However, if a completely unrelated incident occurs, such as a fall resulting in a broken arm, that unrelated injury may be covered, depending on the policy’s terms and conditions.

Importance of Disclosing Pre-existing Conditions

Full disclosure of pre-existing conditions when purchasing travel insurance is paramount. Failing to disclose relevant information can lead to a claim being rejected entirely, even if the complication seems unrelated at first glance. Insurance companies carefully review applications to assess risk. Omitting crucial information is considered a breach of contract and can invalidate your policy. While some insurers offer options to add coverage for specific pre-existing conditions at an increased premium, this must be done *before* your trip commences. Honesty and transparency are key to ensuring your travel insurance provides the protection you need.

Acts of God and Hotel Damage: What Travel Insurance Won’t Cover In Hotel Stays: Know Before You Buy

Travel insurance policies often address damage to hotel rooms, but the extent of coverage varies significantly depending on the cause of the damage. Understanding the distinction between damage caused by Acts of God and damage resulting from human error or negligence is crucial for travelers seeking appropriate protection. This section will clarify how travel insurance typically handles these different scenarios.

Travel insurance generally covers damage to a hotel room caused by natural disasters considered “Acts of God,” although the specific terms and conditions of each policy will vary. Policies typically cover situations where the damage is directly attributable to the unforeseen and uncontrollable natural event, and not due to pre-existing conditions or negligence on the part of the insured. The level of coverage might be limited to the cost of repairs or replacement of personal belongings damaged within the hotel room, and may not cover the cost of the hotel stay itself if the hotel is uninhabitable due to the damage. It is important to carefully review the policy wording for specifics regarding the extent of coverage and any exclusions that might apply.

Examples of Acts of God and Their Impact on Hotel Stay Coverage

Acts of God, also known as force majeure events, encompass a range of natural disasters that are beyond human control. Examples include hurricanes, earthquakes, floods, wildfires, and volcanic eruptions. If a hotel room is damaged due to one of these events, the travel insurance policy might cover the cost of repairing or replacing damaged personal belongings within the room. However, it’s less likely to cover the cost of the entire hotel stay if the hotel is rendered uninhabitable, or if the trip needs to be cut short due to the disaster. For instance, if a hurricane causes significant damage to a hotel, rendering it unsafe, the insurance might cover the cost of relocating to alternative accommodations, but not necessarily the original hotel stay that was interrupted. The specific coverage would depend on the policy terms and the extent of the damage.

Coverage Comparison: Natural Disasters vs. Human Error

| Cause of Damage | Typical Insurance Coverage |

|---|---|

| Natural Disaster (e.g., hurricane, earthquake) | May cover repair or replacement of personal belongings damaged in the hotel room. Coverage for the cost of the hotel stay itself or relocation is less certain and depends on policy specifics. |

| Human Error (e.g., accidental damage to furniture, theft) | Coverage varies widely depending on the policy. Some policies may offer coverage for accidental damage, but theft may require additional supplemental coverage. Pre-existing conditions are usually excluded. |

Lost or Stolen Belongings in Hotels

Travel insurance can offer a valuable safety net when unexpected events occur during a trip, but it’s crucial to understand its limitations regarding lost or stolen belongings, particularly within the confines of your hotel room. While many policies cover theft, the extent of that coverage often comes with significant restrictions and exclusions. Knowing these limitations beforehand can help you make informed decisions about your travel insurance and prepare accordingly.

Many travel insurance policies will cover the loss or theft of belongings from your hotel room, but this coverage is usually subject to several important conditions. Firstly, you’ll typically need to prove that the theft occurred, often requiring a police report. Secondly, the policy will likely specify a maximum payout per item and a total limit for all lost or stolen items. This means that very expensive items, such as high-end jewelry or electronics, might not be fully covered, even if stolen. Finally, many policies exclude certain items from coverage altogether, meaning you may receive no compensation for their loss, regardless of the circumstances.

Excluded Items

Several categories of personal belongings are frequently excluded from travel insurance coverage for theft or loss from hotel rooms. These exclusions are often designed to limit the insurer’s liability for items that are easily replaceable, high-value, or prone to loss due to negligence. Understanding these exclusions is critical for travelers to manage their expectations and protect themselves financially.

- Cash and valuables: Policies typically place strict limits on the amount of cash they will reimburse, often only covering a small sum. High-value items like jewelry, expensive watches, and collectibles are also frequently excluded or subject to very low coverage limits unless specifically declared and added to the policy at an additional cost.

- Electronics without serial numbers: Many insurers require proof of ownership, and recording the serial numbers of expensive electronics is essential to make a successful claim. Without this documentation, a claim for a stolen laptop, camera, or phone may be denied.

- Documents: While the loss of important documents like passports can be incredibly disruptive, many travel insurance policies won’t cover the cost of replacements. Consider this a separate expense that needs to be budgeted for.

- Items left unattended in public areas: Coverage generally only applies to items stolen from a locked hotel room. Items lost or stolen from a hotel lobby, restaurant, or other public areas are usually not covered.

Preventative Measures to Minimize Losses

Taking proactive steps to protect your belongings can significantly reduce your risk of loss and improve your chances of receiving insurance compensation if theft does occur. This includes both preventative measures to avoid theft and steps to facilitate a successful insurance claim should the worst happen.

- Utilize the hotel safe: Hotels usually offer in-room safes, and storing valuable items such as jewelry, passports, and large sums of cash here is strongly recommended. Remember to check the hotel’s liability policy regarding items stored in their safes.

- Keep valuables out of sight: Avoid leaving expensive electronics or jewelry visible in your hotel room. Keep bags and luggage secured and out of view from windows or doors.

- Photographic and written record: Before your trip, photograph or video all valuable items, noting their serial numbers. Keep a separate list of these items and their estimated value. This documentation is crucial for an insurance claim.

- Report theft immediately: If theft does occur, immediately report it to the hotel management and local police. Obtain a police report as this is usually a requirement for insurance claims.

- Review your policy carefully: Before your trip, thoroughly review your travel insurance policy to understand the specific coverage limitations and exclusions related to lost or stolen belongings. This will help you manage your expectations and take appropriate preventative measures.

Illness or Injury Not Requiring Hospitalization

Travel insurance policies often have limitations regarding coverage for illnesses or injuries that do not necessitate hospitalization. While comprehensive policies might offer some level of protection, many standard plans focus primarily on emergencies requiring significant medical intervention. Understanding these limitations is crucial before purchasing a policy.

Many minor ailments and injuries sustained during a hotel stay might not be covered under a typical travel insurance plan. This is because the focus is generally on situations requiring expensive medical care, such as hospitalization, surgery, or extensive treatment. The rationale behind this is that minor issues are often manageable with over-the-counter remedies or readily available medical services, and the cost of treatment is typically lower.

Examples of Excluded Minor Illnesses and Injuries

Minor illnesses and injuries frequently excluded from coverage include common colds, mild allergic reactions, minor cuts and bruises, sunburn, and mild food poisoning. These conditions typically resolve themselves without extensive medical intervention and are considered manageable without hospitalization. For instance, a minor cut requiring a simple bandage would likely not be covered, while a deep laceration needing stitches and medical attention would be. Similarly, a mild case of diarrhea that resolves within a day or two would probably be excluded, whereas a severe case requiring intravenous fluids and hospitalization would be covered.

Comparison of Coverage for Minor and Major Injuries

The difference in coverage between minor injuries and major injuries requiring hospitalization is significant. Major injuries, such as fractures, serious infections, or severe allergic reactions requiring emergency medical care, are usually covered under most travel insurance policies. This coverage typically includes expenses for emergency medical treatment, hospitalization, ambulance transport, and sometimes even medical evacuation. Conversely, minor injuries that do not require hospitalization are often excluded, leaving the traveler responsible for all associated medical costs, such as doctor visits or medication. A simple sprain, for example, might not be covered, while a broken bone requiring surgery and rehabilitation would likely be covered. The key distinction hinges on the severity of the injury and the necessity of hospitalization or extensive medical intervention.

Hotel Cancellation Policies and Insurance

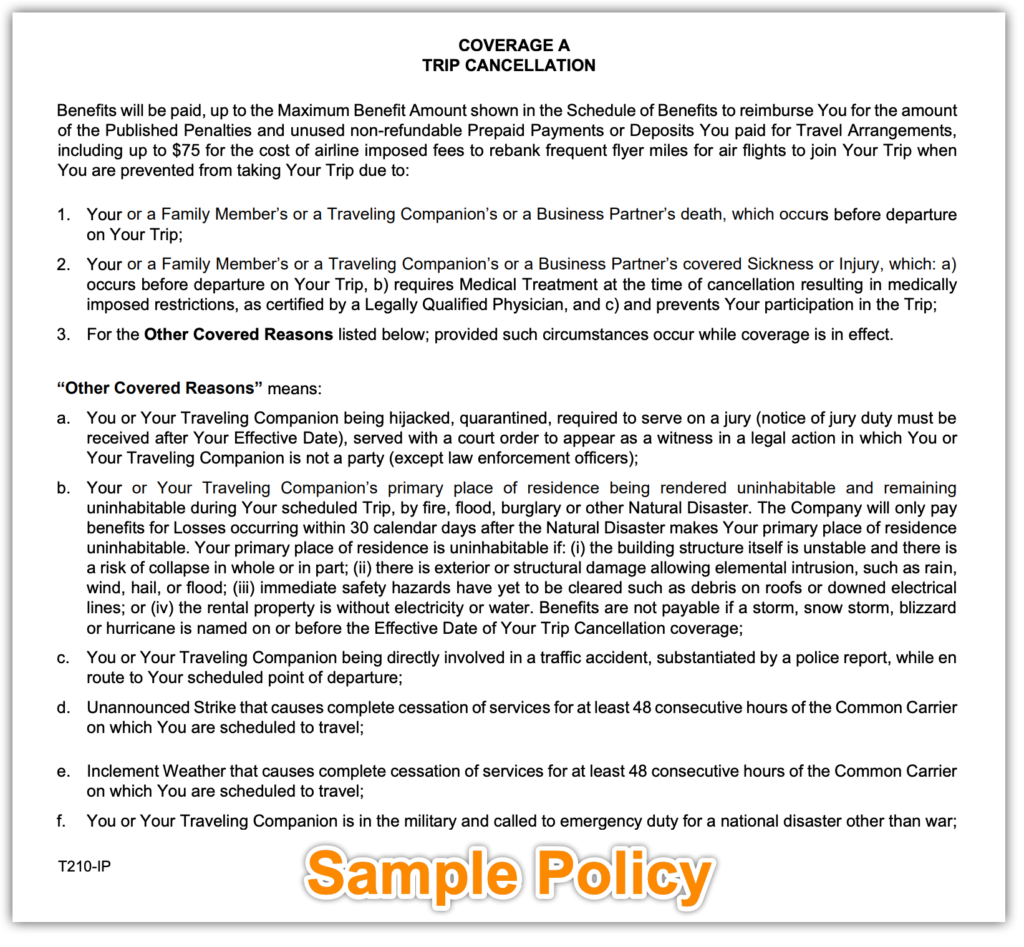

Travel insurance and hotel cancellation policies often work in tandem, but it’s crucial to understand their distinct roles and limitations. While travel insurance can sometimes cover unexpected cancellations, it doesn’t automatically guarantee reimbursement for every instance. The specifics of your coverage depend heavily on the terms of your insurance policy and the reason for cancellation. Understanding this interplay is vital to avoid disappointment and financial loss.

Hotel cancellation policies vary widely, ranging from flexible options with full refunds to strict policies with significant penalties or no refunds at all. These policies are set by the hotel itself and are independent of your travel insurance. Travel insurance typically only steps in to cover cancellations when specific, unforeseen circumstances arise, as defined in your policy’s terms and conditions. This means you might still be responsible for cancellation fees even with insurance if your reason for cancellation isn’t covered.

Situations Where Hotel Cancellations Are Not Covered by Travel Insurance

Many situations that lead to hotel cancellations are not covered by standard travel insurance policies. It’s essential to carefully review your policy’s exclusions before relying on it to cover cancellation costs. A common misconception is that travel insurance is a blanket guarantee for any cancellation. This is rarely the case.

- Changing your mind: Simply deciding you no longer wish to travel or have a change of heart is typically not covered. Travel insurance is designed for unforeseen and unavoidable circumstances, not for second thoughts.

- Missed flights due to lack of planning: Failing to arrive on time for your flight due to insufficient planning (e.g., forgetting your passport, missing the check-in deadline) is usually not covered. Travel insurance generally covers unforeseen delays, not self-inflicted ones.

- Cancellations due to personal reasons: Reasons such as family disputes, relationship issues, or work commitments generally aren’t covered. These are considered foreseeable circumstances that could have been planned for.

- Failure to meet the hotel’s cancellation deadline: If you miss the hotel’s stated cancellation deadline, even if it’s due to an unforeseen circumstance, your insurance may not cover the resulting penalties. Always adhere to the hotel’s cancellation policy.

- Cancellations due to mild illness or injury: While severe illnesses or injuries that require hospitalization may be covered, minor illnesses or injuries that don’t prevent travel are usually not covered. This is often stated clearly in the policy’s terms and conditions.

Interplay Between Hotel Cancellation Policies and Travel Insurance Coverage

Your travel insurance policy should be viewed as a supplemental protection, not a replacement for a hotel’s cancellation policy. It’s vital to always check both the hotel’s cancellation policy and your travel insurance policy to understand the extent of your protection. For instance, even if your travel insurance covers a specific unforeseen event, the hotel might still apply cancellation fees. In such a case, your insurance might only reimburse you for a portion of the fees or require you to first seek reimbursement from the hotel.

Always read both your hotel’s cancellation policy and your travel insurance policy carefully before making your booking.

Common Reasons for Hotel Cancellations Not Typically Covered

Understanding common reasons for hotel cancellations that aren’t covered by insurance is key to avoiding unexpected expenses. These often involve circumstances that are considered preventable or foreseeable.

- Personal preference changes: A change of mind regarding the travel destination or dates.

- Financial difficulties: Inability to afford the trip after booking.

- Work-related issues: Unexpected work commitments that prevent travel.

- Family matters: Unforeseen family issues that are not emergencies.

- Better travel deals: Finding a more attractive travel package after booking.

Activities Outside the Hotel and Insurance Coverage

Travel insurance policies often have limitations regarding coverage for incidents or injuries that occur outside the confines of your hotel. While the specific details vary widely depending on the policy, understanding these limitations is crucial before you embark on your trip to avoid unexpected financial burdens. Failing to do so could leave you responsible for significant medical expenses or other costs related to unforeseen events.

Many travel insurance policies provide coverage for medical emergencies, but the extent of this coverage frequently depends on the location and circumstances of the incident. For example, coverage might be more comprehensive for emergencies occurring within a specified geographic area or those resulting from covered activities. Conversely, injuries sustained during activities specifically excluded by the policy, or in areas deemed unsafe by the insurer, may not be covered at all. This is why careful review of your policy’s terms and conditions is essential before your travel.

Activities with Limited or Excluded Coverage

It’s important to understand that activities such as extreme sports (bungee jumping, skydiving, etc.), adventure tourism (mountaineering, white-water rafting, etc.), and participation in organized or unorganized sporting events may have limited or no coverage under standard travel insurance policies. Policies often specify exclusions for activities deemed inherently risky. This isn’t to say that you can’t participate in these activities, but it is crucial to understand that you’ll likely need to purchase specialized insurance or accept personal responsibility for any resulting costs.

For example, a policy might cover medical expenses resulting from a minor injury sustained while hiking a well-maintained trail, but it would likely exclude coverage for a severe injury sustained while rock climbing without appropriate safety equipment and/or a licensed guide, particularly in a remote area. The policy would likely classify rock climbing as an excluded high-risk activity. Similarly, a standard travel insurance policy would probably not cover injuries sustained in an unsanctioned motor vehicle race, even if the injury occurred away from the hotel.

Understanding the Scope of Coverage for Activities Away from the Hotel

Before purchasing travel insurance, carefully examine the policy’s definition of “covered activities.” This section often Artikels the types of activities the insurance company will cover should an incident occur. It’s equally crucial to identify the policy’s exclusions, which detail the circumstances and activities for which no coverage is provided. Pay close attention to geographical limitations; some policies offer reduced or no coverage in certain regions known for high risk or political instability. Consider purchasing a supplemental policy if you plan to engage in high-risk activities. This supplemental policy can provide specific coverage for these activities, ensuring you’re protected even if the primary travel insurance policy does not. For instance, a traveler planning a week-long mountaineering expedition in the Himalayas should consider purchasing specialized adventure travel insurance, in addition to standard travel insurance, to fully protect themselves against potential accidents and injuries.

Fraudulent Claims and Hotel Stays

Filing a fraudulent insurance claim, regardless of the circumstances, carries significant consequences. Insurance companies have sophisticated methods to detect fraudulent activity, and the penalties for being caught can be severe, impacting your financial standing and potentially leading to legal repercussions. Understanding these risks is crucial before considering making a false claim.

Insurance companies employ various techniques to investigate suspected fraudulent claims. These investigations often involve a thorough review of the claim documentation, cross-referencing information with other sources, and potentially contacting witnesses or conducting site visits. Advanced data analytics are frequently used to identify patterns indicative of fraud, comparing the claim to others made by the same individual or from the same hotel. Furthermore, investigators may employ surveillance techniques or conduct interviews to gather evidence. The more elaborate the fraudulent claim, the more extensive and rigorous the investigation will be.

Consequences of Filing a Fraudulent Claim

Submitting a fraudulent claim related to a hotel stay can result in the immediate denial of your claim. Beyond this, your insurance policy may be canceled, preventing you from making legitimate claims in the future. Furthermore, insurance companies often report fraudulent claims to a central database, making it difficult to obtain insurance from other providers. Depending on the severity of the fraud, you may face legal action, including hefty fines and even criminal charges. The financial and reputational damage caused by a fraudulent claim far outweighs any potential short-term gain.

Investigation of Potential Fraudulent Claims

A typical investigation begins with a review of the claim documentation. Inconsistencies in the narrative, discrepancies between the claim and other evidence, or a lack of supporting documentation will raise red flags. The insurance company might then contact the hotel to verify the claimant’s version of events. They may review security footage, interview hotel staff, and examine any records related to the stay. If the investigation reveals evidence of fraud, the claimant will be contacted and given an opportunity to respond. Failure to provide a satisfactory explanation will likely lead to the denial of the claim and potential further action.

Scenario: A Potentially Fraudulent Claim

Imagine a traveler claiming their expensive laptop was stolen from their hotel room. However, their claim lacks supporting evidence, such as a police report. Their account of the events differs slightly from the hotel’s security footage, which shows them leaving the room with a bag that appears to be the same size as the claimed laptop case. Furthermore, their claim is made several weeks after their stay, with no prior notification of the incident to the hotel. In this scenario, the insurance company would likely investigate further. The discrepancies between the claim and the evidence, along with the lack of a timely report, would strongly suggest fraud, leading to a denial of the claim and potentially further legal action.

Unforeseen Circumstances and Exclusions

Travel insurance, while offering a safety net for unexpected events, often excludes certain unforeseen circumstances during a hotel stay. Understanding these exclusions is crucial to avoid disappointment and financial burden. This section will clarify common exclusions and their reasons, empowering you to make informed decisions when purchasing travel insurance.

What Travel Insurance Won’t Cover in Hotel Stays: Know Before You Buy – Many unforeseen circumstances are excluded because they are considered either highly improbable, difficult to verify, or fall under the purview of other types of insurance. For instance, events like minor inconveniences or issues that don’t significantly impact your trip are usually not covered. Similarly, events that are easily preventable with reasonable care are often excluded from coverage. The aim is to provide insurance for significant, unexpected disruptions, not for minor annoyances or easily avoidable problems.

Common Unforeseen Circumstances and Coverage Likelihood

The following table Artikels several unforeseen circumstances that might occur during a hotel stay and the likelihood of your travel insurance covering the associated costs. It’s important to note that coverage always depends on the specific terms and conditions of your chosen policy. Always review your policy wording carefully before relying on coverage.

| Unforeseen Circumstance | Likelihood of Coverage | Example |

|---|---|---|

| Minor inconvenience (e.g., noisy neighbors) | Unlikely | A slightly noisy hotel room that doesn’t significantly disrupt your sleep. |

| Hotel room significantly below advertised standards | Possibly, depending on policy and severity | A room with significant cleanliness issues or missing amenities as advertised (e.g., no working air conditioning in a hot climate). Evidence and documentation are crucial. |

| Personal property damage not caused by a covered event | Unlikely | Accidental damage to your personal belongings (e.g., breaking a phone) not resulting from a covered incident like theft or a natural disaster. |

| Disruption due to a non-covered event (e.g., local protest) | Unlikely | A local protest causing temporary road closures near the hotel, leading to minor delays but not preventing access to the hotel. |

| Unexpected additional expenses not directly related to a covered event | Unlikely | Increased taxi fares due to unexpected traffic unrelated to a covered event. |

Terrorism and Civil Unrest

Travel insurance policies generally address the impact of terrorism and civil unrest on hotel stays, but the extent of coverage varies significantly between providers and specific policy details. Understanding these variations is crucial before purchasing a policy, as these events can lead to significant disruptions and financial losses.

Travel insurance policies typically cover expenses incurred due to disruptions caused by terrorism or civil unrest if these events prevent you from staying at your booked hotel. This might include reimbursement for prepaid, non-refundable hotel accommodations, or costs for alternative accommodations if your original hotel becomes unsafe or inaccessible. However, coverage is usually limited to the duration of the event and may not extend to other unforeseen expenses.

Coverage for Terrorism and Civil Unrest Related Hotel Disruptions

Most travel insurance policies define terrorism and civil unrest in their policy documents. These definitions usually include acts of violence, riots, and other disturbances that disrupt public order. It is essential to carefully review these definitions as they can vary slightly from company to company. For example, some policies may exclude acts of terrorism explicitly sponsored by a specific government, while others may have broader definitions that encompass a wider range of events. Claims are typically assessed on a case-by-case basis, taking into account the specific circumstances and the policy’s terms and conditions.

Examples of Covered Events and Their Implications

Consider a scenario where a hotel is damaged or rendered uninhabitable due to a bombing, an act of terrorism. A valid travel insurance policy would likely cover the cost of alternative accommodation and any additional expenses reasonably incurred in relocating. Similarly, if civil unrest forces the evacuation of a hotel, causing you to lose your prepaid stay, a travel insurance policy could potentially reimburse you for the lost accommodation cost. Conversely, if you choose to leave a hotel due to fear or anticipation of an event, without any actual disruption to the hotel’s services or your safety, coverage might be denied. The key is that the event must directly impact your ability to use the booked accommodation.

Coverage Variations Among Insurance Companies

The level of coverage for terrorism and civil unrest varies considerably among insurance providers. Some insurers may offer comprehensive coverage, including expenses for alternative accommodations, transportation, and emergency medical care, while others may offer limited coverage or exclude these events entirely. For example, one company might offer a maximum payout of $5,000 for such events, while another might offer only $1,000 or even exclude it from their basic plan. It’s essential to compare policies from multiple providers and carefully read the fine print to understand the specific coverage limits and exclusions before purchasing. Always confirm whether terrorism and civil unrest are covered events and the specific parameters under which a claim would be approved.

Reading and Understanding Policy Documents

Purchasing travel insurance offers a crucial safety net for unforeseen events during your trip. However, the effectiveness of this protection hinges entirely on your comprehension of the policy’s terms and conditions. Failing to thoroughly review your policy before departure can lead to significant disappointment and financial burden should you need to make a claim.

Understanding your travel insurance policy is paramount. It’s not simply a matter of buying a product; it’s about securing a contract that Artikels your rights and the insurer’s obligations. A clear understanding protects your interests and ensures you receive the coverage you expect.

Key Sections of a Travel Insurance Policy

Before purchasing any travel insurance, it is vital to carefully examine several key sections of the policy document. Overlooking these crucial areas could result in your claim being denied, even if you believe you are covered.

- Covered Events: This section details the specific circumstances under which the insurance company will provide compensation. Pay close attention to the precise wording, as some policies may exclude certain events or situations that you might initially assume are covered. For example, a policy might cover medical emergencies but exclude pre-existing conditions.

- Exclusions: This section lists events or situations that are explicitly not covered by the insurance. Common exclusions might include pre-existing medical conditions, reckless behavior, or participation in dangerous activities. Understanding these exclusions is critical to avoid disappointment.

- Claim Procedures: This section Artikels the steps you must take to file a claim. Note any deadlines for reporting incidents, required documentation (such as receipts and medical reports), and the process for submitting your claim. Knowing these procedures in advance will streamline the process should you need to make a claim.

- Policy Limits and Deductibles: This section specifies the maximum amount the insurer will pay for a particular event and any deductible you are responsible for paying before the insurer begins to cover costs. For example, a policy might have a maximum payout of $10,000 for medical expenses, with a $250 deductible.

- Definitions: This section clarifies the meaning of key terms used throughout the policy. Understanding these definitions is essential to ensure you are interpreting the policy correctly. For instance, the policy may define “emergency medical care” in a specific way that may not align with your interpretation.

Consequences of Not Understanding the Policy

Failing to understand the terms and conditions of your travel insurance policy can have serious financial and emotional consequences.

- Claim Denial: The most significant consequence is the denial of your claim. If your claim does not meet the policy’s specific criteria, even if you believe you are covered, the insurer may reject your claim, leaving you responsible for all related costs.

- Unexpected Expenses: Without a clear understanding of the policy, you might underestimate the costs associated with unforeseen events. This can lead to significant out-of-pocket expenses that could have been avoided with proper policy understanding.

- Legal Disputes: In cases of complex claim denials, resolving the issue might require legal action, incurring additional costs and time. This could easily be avoided with proper understanding and documentation.

- Stress and Anxiety: Dealing with unexpected events during travel is stressful enough. The added stress of a disputed claim only exacerbates the situation, impacting your enjoyment of the trip and potentially causing significant emotional distress.

Top FAQs

What if my hotel room is damaged due to my own negligence?

Most travel insurance policies will not cover damage to your hotel room caused by your own actions or negligence. Check your policy for specifics.

Does travel insurance cover lost cash in my hotel room?

Generally, travel insurance policies have limitations on cash coverage. It’s often advisable to keep only small amounts of cash in your hotel room.

What constitutes a “pre-existing condition” for travel insurance purposes?

A pre-existing condition is any medical condition you had before purchasing your travel insurance policy. The definition can vary between insurers, so review your policy carefully.

Can I claim for a hotel cancellation if I simply change my mind?

No, travel insurance typically doesn’t cover cancellations due to a change of plans. Most policies require a valid reason for cancellation, such as illness or unforeseen circumstances.